In the UAE’s VAT system, Form 211 allows taxpayers to fix mistakes in their previous submissions, giving them the power to address errors or omissions proactively. Facilitated by the Federal Tax Authority (FTA), this process allows entities to correct information within VAT Returns (Form 201), ensuring accurate reporting of Payable Tax.

This article highlights the significance of Form 211, explaining when and how to deploy it, with practical insights through an illustrative example. It also describes potential penalties in the submission of VAT Voluntary Disclosure and the role of a professional Now Consultant that offers expert guidance to businesses seeking to navigate VAT Voluntary Disclosure, ensuring comprehensive assessment and mitigation of potential fines and penalties.

What is VAT Voluntary Disclosure in UAE VAT Law?

A VAT Voluntary Disclosure, available as Form 211 from the Federal Tax Authority (FTA), lets taxpayers proactively report mistakes or omissions in their previous Tax Return, Tax Assessment, or Tax Refund application. Every taxable entity has the opportunity to correct information previously submitted in the VAT Return (Form 201).

The voluntary disclosure option enables the taxable entity to rectify any inaccuracies in the previously declared tax amount. Form 211, the VAT voluntary disclosure form, can be utilized to voluntarily inform the authority and address discrepancies before they are identified during a tax audit or through an assessment.

How To Correct Errors by Voluntary VAT Disclosure?

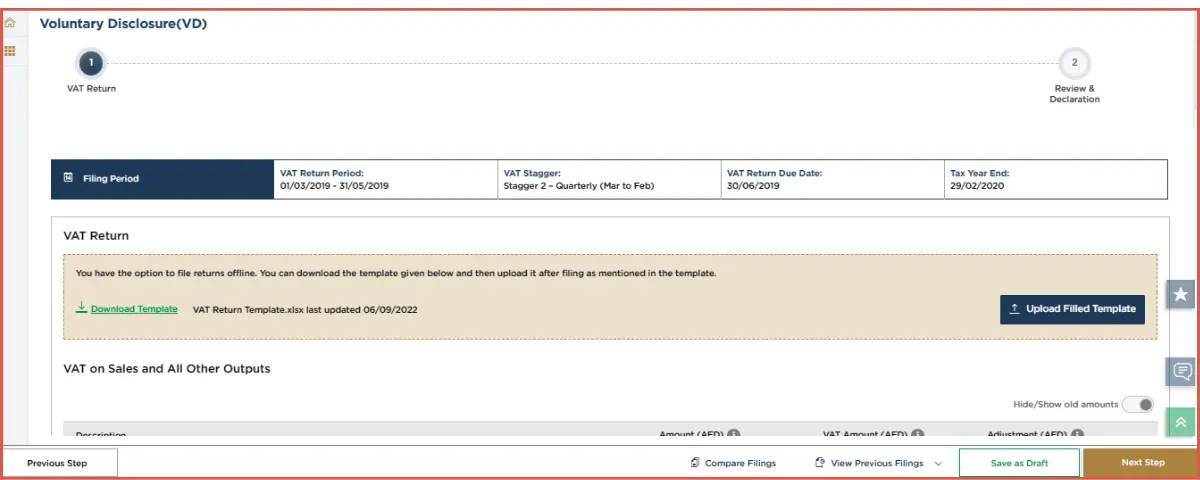

If a Voluntary VAT disclosure is necessary, it should be submitted through the FTA portal. Registered users can access the FTA portal using their credentials and navigate to the “VAT 211 – VAT Voluntary Disclosure/Tax Assessment” tab.

The portal will display a list of previously filed VAT returns as shown in the above image, allowing users to choose the specific return for which voluntary disclosure is required.

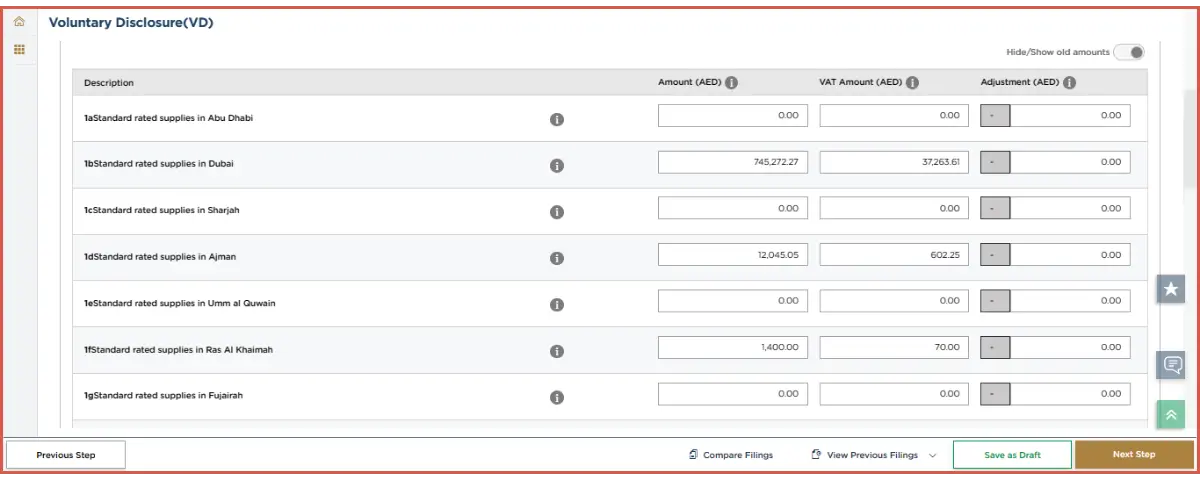

Once selected, users can update the return amounts with accurate figures.

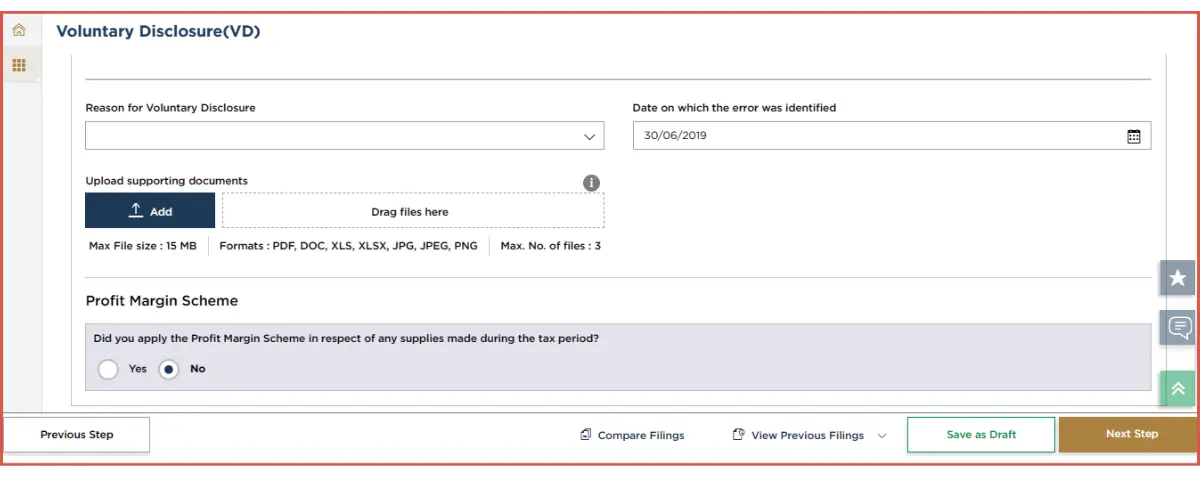

Alongside the voluntary disclosure, relevant details must be uploaded to justify the correction made to the VAT return.

When to Use Voluntary Disclosure Form 211?

The Voluntary Disclosure Form 211 applies in specific scenarios where taxpayers must submit it to the FTA. This usually happens when a taxpayer notices a mistake or omission in a VAT Return, VAT Assessment, or VAT Refund application, as explained below:

1. Unreported Tax Amount:

Imagine finding mistakes in a VAT return or assessment submitted to the FTA, causing the calculated Payable Tax to be less than it should be. In that case, you are required to submit a VAT Voluntary Disclosure to rectify the mistake.

2. Overstated Payable Tax:

In cases where you realize that a VAT return or assessment sent by the FTA is inaccurate, leading to an overestimation of the Payable Tax, you can submit a VAT Voluntary Disclosure to correct the error.

3. Inaccurate VAT Refund Request:

Imagine realizing that a VAT refund application sent to the FTA has errors, leading to an overestimated refund amount. In that case, it is imperative to submit a Voluntary Disclosure to correct this error.

In these instances, the Voluntary Disclosure Form 211 is crucial for rectifying inadvertent errors and ensuring accurate VAT reporting.

Example of VAT Voluntary Disclosure:

For instance, Company-X initially submitted VAT Return Form 201 for April 2023, declaring standard-rated sales as AED 1,500,000 with an output VAT of AED 75,000. However, in May 2023, it was revealed that the actual standard-rated sales were AED 1,750,000, resulting in an output VAT of AED 87,500.

This indicates that Company-X has inadvertently underpaid the tax by AED 12,500 for the April 2023 VAT Returns. Once the mistake is found, they must promptly inform the FTA about it using the Voluntary Disclosure Form.

Penalties on Submission of VAT Voluntary Disclosure?

There are two categories of penalties when you submit a Voluntary Disclosure:

1. Fixed Penalty:

For the initial submission of a Voluntary Disclosure (Form 211) without any prior notification from the FTA, a fixed penalty of AED 3,000 is applicable.

Subsequent submissions of Form 211 will incur a fixed penalty of AED 5,000.

2. Percentage-Based Penalty:

This penalty is calculated based on the disparity in the originally reported amount.

For instance, if you initially disclosed a tax liability of AED 100,000 but later discovered it should have been AED 150,000, the percentage-based penalty will be imposed on the difference between these amounts, i.e., AED 50,000.

FAQs:

What Are The Time Limits For Voluntary Disclosure?

The voluntary disclosure should be initiated within 20 business days of identifying the error; otherwise, penalties may be imposed. All businesses subject to tax must submit their VAT returns accurately and on time, following the timeline set by the FTA.

How Do I Find The Errors In The Submitted VAT Return?

Errors in submitting a VAT return can occur due to incorrect filing and calculation of taxes. Mistakes arise in determining the place of supply among the seven states. The import figure could also auto-populate or sometimes need manual input in the VAT return.

When Should You Refrain From Submitting a VAT Voluntary Disclosure?

Businesses are exempt from submitting a Voluntary Disclosure for underpaid tax if the Payable Tax amount is equal to or less than AED 10,000, provided the entity can rectify the error within the Tax Return for the respective tax period in which the error was identified.

How Can We Help You?

VAT Voluntary Disclosure in UAE is a crucial tool for businesses and companies aiming to sidestep VAT fines and penalties. To assess and address potential cascading consequences comprehensively, seek professional advice from registered tax consultants before initiating any Voluntary Disclosures.

Now Consultant, recognized as the best audit firm in the UAE, stands ready to guide you through submitting a VAT voluntary disclosure to the FTA. If you’ve encountered an error in managing your VAT, there’s no need to panic; reach out to Now Consultant to navigate your VAT voluntary disclosure.