In UAE VAT, the reverse charge mechanism has the same significance as the forward charge mechanism. According to Article 48(3) of the Federal Decree-Law, the recipient is responsible for calculating and paying the tax to the government under the Reverse Charge Mechanism (RCM). This mechanism shifts the tax burden from the supplier to the buyer for specified supplies.

The article explains how the RCM alters the traditional tax payment dynamics, emphasizing the buyer’s obligation to settle the tax directly with the government. It highlights the purpose of RCM in ensuring comprehensive VAT collection on imported and domestically supplied goods or services, even if the supplier is not subject to taxation.

What Is Reverse Charge Mechanism In UAE VAT?

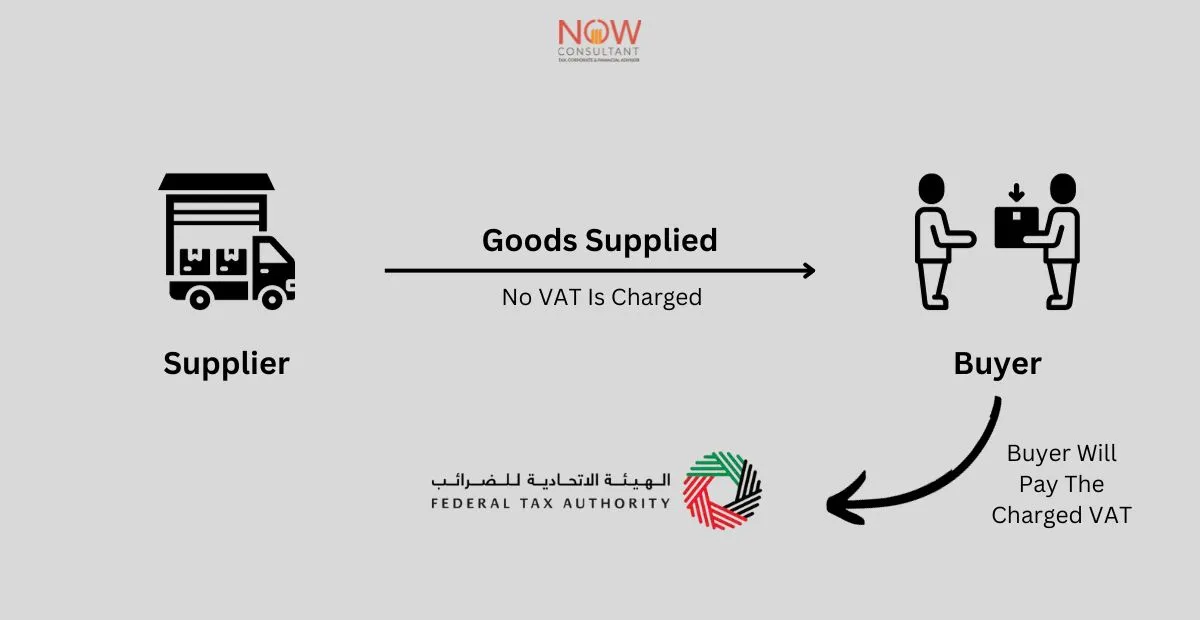

In a standard business setup, the supplier typically provides goods to customers and collects VAT from them, subsequently remitting it to the Federal Tax Authority (FTA). While the reverse charge mechanism (RCM) transforms this procedure, as the supplier abstains from levying VAT on the customer. Instead, the obligation to settle the tax is transferred directly to the buyer or end customer, who remits it to the government authority as shown in the infographic below:

Significantly, the supplier is relieved of the obligation to pay VAT on imported items. Hence, the obligation to report a VAT transaction transitions from the seller to the recipient. Subsequently, the recipient must record both the VAT incurred on purchases (input VAT) and the VAT collected on sales (output VAT) in their quarterly VAT report.

In cases where the supplier is located outside the country and lacks a business presence in the UAE, VAT does not apply to businesses outside the UAE. As a result, individuals in the UAE receiving goods from a supplier outside the UAE must settle VAT using a reverse charge method.

Why You Need Reverse Charge?

The Reverse Charge mechanism plays a crucial role when a supplier does not have a business presence in the UAE. Without this mechanism, it would be difficult for the Federal Tax Authority (FTA) to monitor and ensure VAT compliance in business transactions with non-resident suppliers.

To streamline the procedure, residents of the UAE must fulfill their VAT obligations through a reverse charge approach. This method is especially pertinent for cross-border transactions, as it relieves non-resident suppliers from the responsibility of registering and handling VAT accounting in the location of their buyers.

Example of Reverse Charge Mechanism:

Imagine a company called ABC Ltd in the UAE importing goods worth AED 5500 from XYZ Ltd in the UK. While ABC Ltd is VAT registered, XYZ Ltd isn’t registered in the UAE. In this scenario, XYZ Ltd doesn’t have to file returns or pay tax in the UAE.

From a VAT perspective, as ABC Ltd bought goods from a non-UAE supplier, the Reverse Charge Mechanism applies. ABC Ltd needs to note this in their VAT return. As a registered importer, ABC Ltd must pay 5% VAT on AED 5500, which is AED 275, to the government.

Requirements of Reverse Charge Mechanism

The Reverse Charge Mechanism involves the following criteria:

- VAT registration is a prerequisite for the recipient of the goods or services.

- It is mandatory for every registered business proprietor to maintain accurate records of transactions involving reverse charges.

- Ensure that invoices, receipt vouchers, and refund vouchers clearly specify whether the tax payment for a particular transaction is subject to the reverse charge mechanism.

When Reverse Charge Mechanism is Applicable?

The reverse charge applies in the following scenarios:

- Importing goods or services from both GCC and non-GCC countries, where the supplier is based in another country, regardless of having a business presence in the UAE.

- Acquiring goods from a designated zone.

- Transactions involving the supply of gold and diamonds.

- Purchasing gold and diamonds for resale or further production/manufacturing.

- Supplying hydrocarbons for resale, originating from a registered supplier to a registered recipient within the UAE.

- Providing either crude or refined oil from a registered supplier to a registered recipient in the UAE.

- Delivering either processed or unprocessed natural gas from a registered supplier to a registered recipient in the UAE.

- Producing and distributing any form of energy by a registered supplier to a registered recipient in the UAE.

FAQs:

What Is Reverse Charge Mechanism In GST?

In GST, the reverse charge means if the seller in the UAE isn’t paying taxes, you, as the buyer, need to pay them directly to the government when you buy something. This makes sure the government still gets the tax, even if the seller isn’t officially registered for taxes in the UAE.

How To Account For Reverse Charge Mechanism?

In order to account for the reverse charge mechanism, compute the tax owed to the government and self-account for the VAT amount as output tax during the purchase. Include it in your VAT filing.

How to Make Payment Under Reverse Charge Mechanism?

To make payments using the reverse charge mechanism, make sure that invoices, receipt vouchers, and refund vouchers clearly indicate whether the transaction’s tax liability is under the reverse charge arrangement.

If I’m Part Of a Reverse Charge Transaction As The Recipient, What Should I Do?

If you find yourself as the recipient in a reverse charge transaction, ensure to compute the applicable tax, independently account for the VAT amount as output tax at the time of purchase, and include this information when declaring it in your VAT return.

How We Can Help You?

To proceed with the appropriate and accurate application of the Reverse Charge Mechanism (RCM) is a difficult task that requires expert guidance and experience to align with the VAT laws in the UAE. The expert team of NOW Consultants makes sure of the applicability and due process of RCM while accomplishing all the updated requirements.

Our prompt and effective services serve as a safeguard against substantial fines and penalties resulting from non-compliance. Furthermore, our expertise extends to a wide range of VAT services, encompassing VAT registration, VAT return filing, VAT audit, VAT refund, VAT accounting, and VAT deregistration.