The filing of VAT returns in the UAE involves meeting specific requirements and submitting a comprehensive report detailing sales, purchases, and tax liabilities. Businesses, based on their turnover, are obliged to file returns either quarterly or monthly. The VAT return form, known as ‘VAT 201,’ contains seven main sections outlining details of sales, expenses, and tax amounts due.

The process involves accessing the EMARATAX portal, inputting data, and reviewing before final submission. Not submitting the required documents punctually may result in penalties specified by the tax laws in the UAE. Seeking professional assistance, like NOW Consultant is advised to ensure FTA compliance and avoid potential fines.

What Is a VAT Return?

A tax return is a comprehensive report that outlines all the sales and purchases conducted within a specific tax period. It encompasses imports, exports, and exempt supplies and details the VAT amounts paid or collected for each transaction.

This report must be created based on your invoices and submitted through the FTA e-portal. In the UAE, every registered taxpayer must produce and submit a VAT return for each designated tax period.

What Is VAT Return Form (VAT 201 Form):

The VAT Return form, labeled as ‘VAT 201,’ must be completed and submitted by the taxpayer to finalize the VAT Return filing process. Form VAT 201 consists of 7 main sections outlined as follows:

- Details of the Taxable Person

- VAT Return Period

- VAT related to sales and other outputs

- VAT associated with expenses and other inputs

- Net VAT Amount Due

- Supplementary reporting requirements

- Declaration and Authorized Signatory

Procedure of VAT Return Filing in UAE

The following alienates the step-by-step procedure with images for submitting a VAT return in the United Arab Emirates:

Step 1:

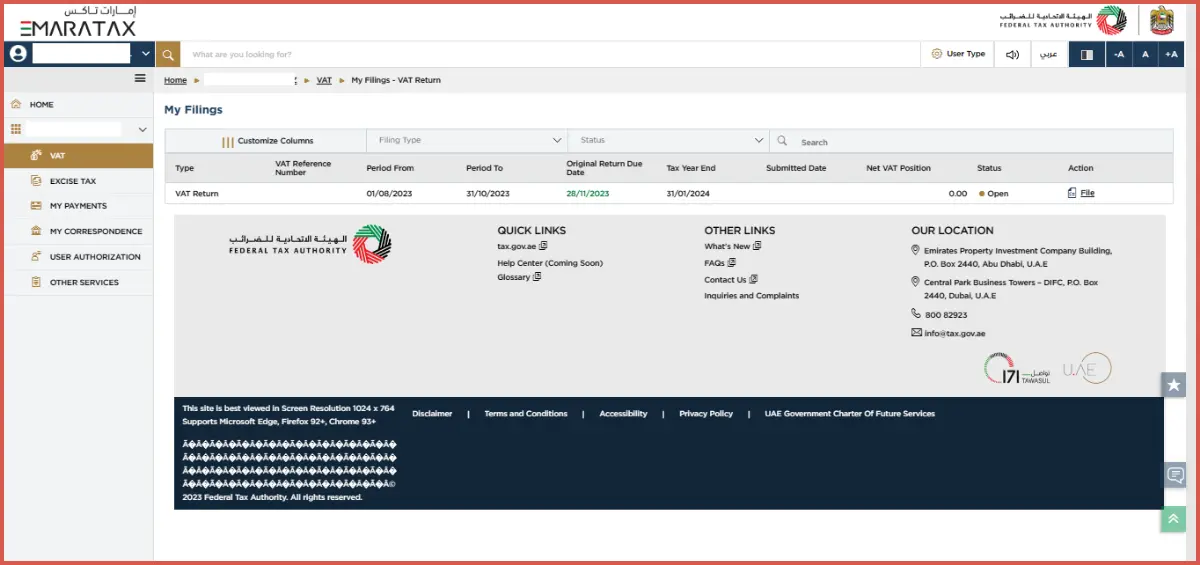

Initiate the process by accessing the EMARATAX portal using the designated username and password registered for the account.

- Proceed by navigating through the menu options and follow the specific path detailed below:

- VAT → ‘View All’ under ‘My Filings’ → Click on ‘File’ for the designated return period.

Step 2:

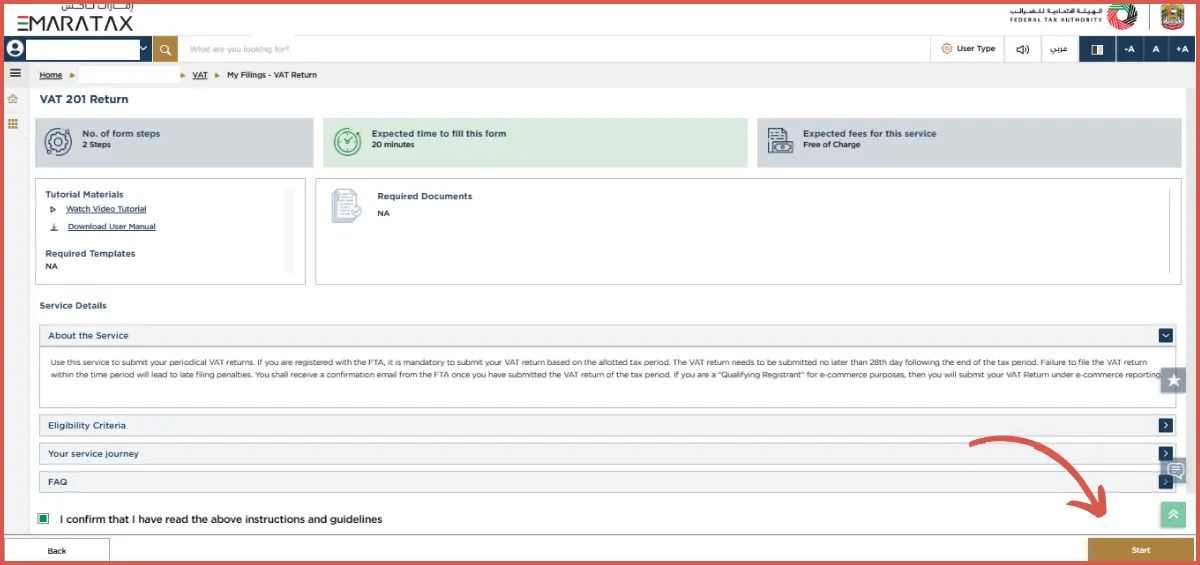

After navigating, affirm your adherence to the provided guidelines by checking the designated box and then proceed by clicking the ‘Start’ button to continue with the filing process.

Step 3:

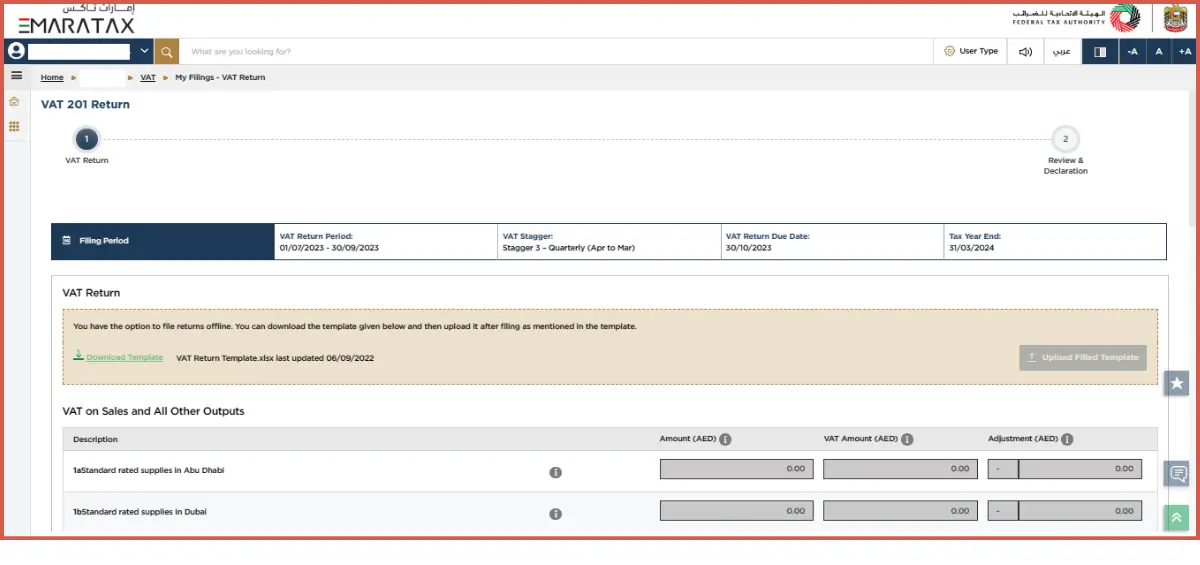

The system will display the comprehensive details of the filing period corresponding to the selected VAT return, as shown in the next step.

Step 4:

Utilize the offline template to input data offline. Download the template, fill in the necessary information, and upload the Excel file. Upon completion, review the uploaded Excel for potential errors or clear data for the uploading of a revised Excel file.

- Enter the requisite amounts, VAT figures, and adjustments into their corresponding boxes.

- Complete Box 1 with the specifics of standard rate sales made within the respective emirate.

Step 5:

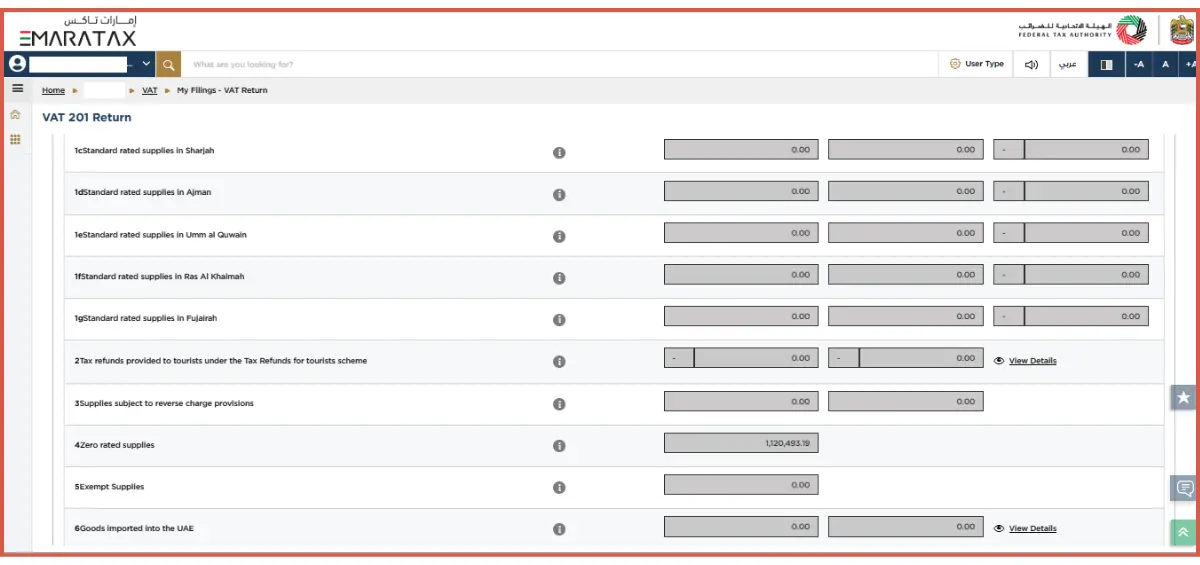

The system will automatically populate Box 2 with the tax refunds granted to tourists under the ‘Tourist Refund Scheme’ from the ‘Planet Tax-Free system.’ Additionally, you can view the pre-filled data by clicking on ‘View Details.’

- Enter details of sales made under reverse charge provisions into Box 3.

- Provide details of zero-rated and exempt sales in Boxes 4 and 5, respectively.

- Data from Customs will automatically fill Box 6.

- For incomplete or inaccurate import data, adjustments can be made using Box 7.

- Box 8 encapsulates the total of Box 1 to Box 7, signifying the total sales and tax liability for the applicable return period.

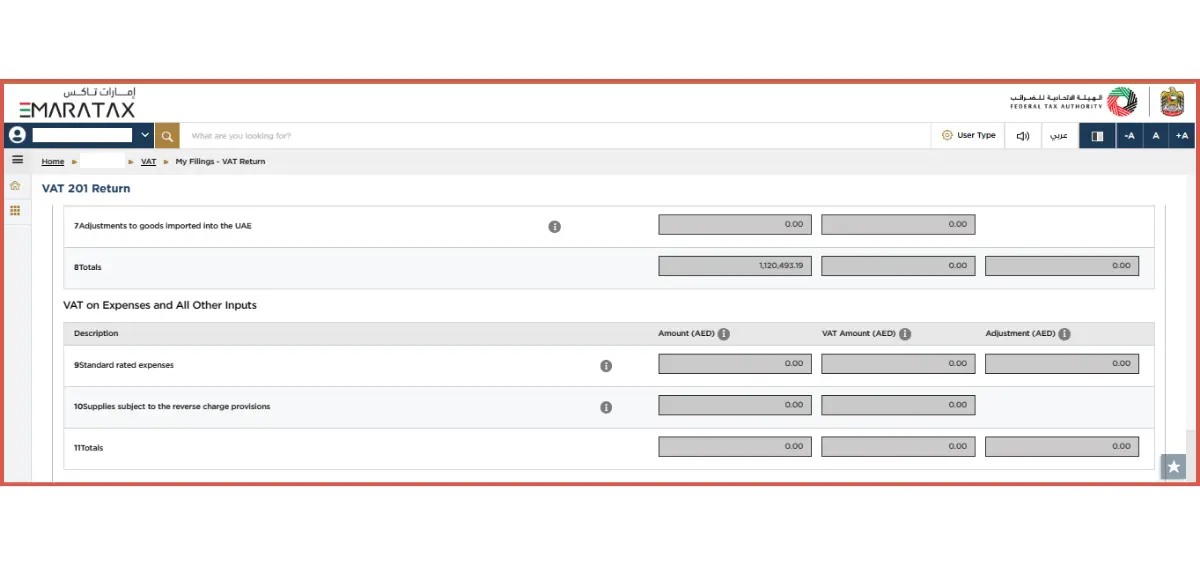

- Input the amount, VAT figures, and adjustments for standard-rated expenses in Box 9.

- Complete the reverse charge acquisitions in Box 10.

- Box 11 sums up the total inputs for the return period, combining the data from Boxes 9 and 10.

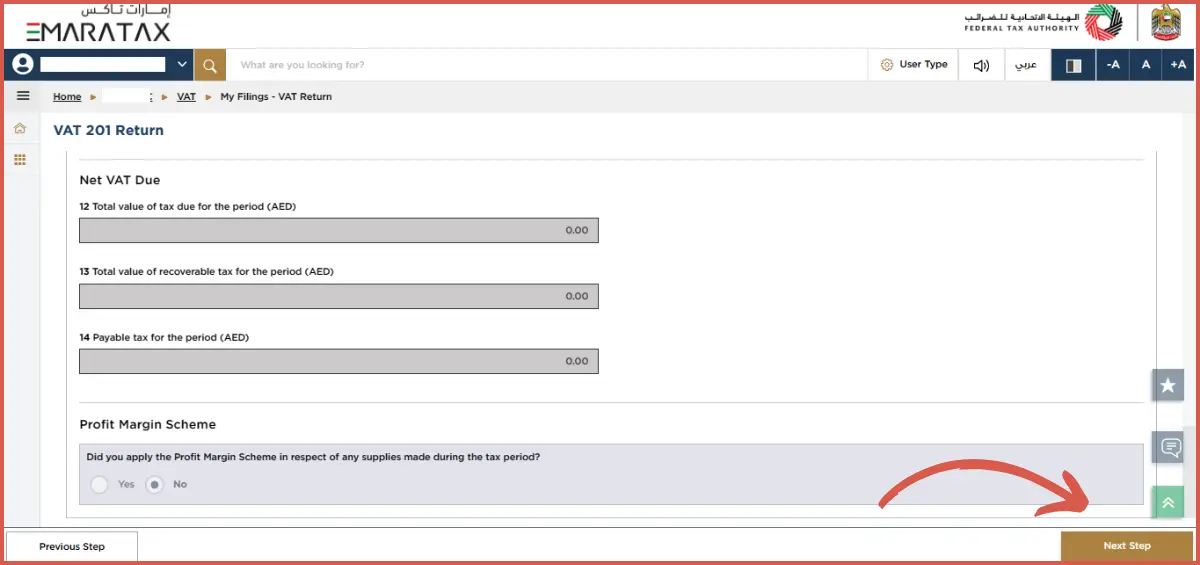

- Boxes 12 and 13 represent the total output and input taxes for the return period, while Box 14 displays the tax payable or refundable for the specified period.

- Indicate ‘Yes’ or ‘No’ under ‘Profit Margin Scheme’ according to your reporting method, then click ‘Save as Draft’ to secure the submitted details. Proceed by clicking ‘Next Step’ to advance.

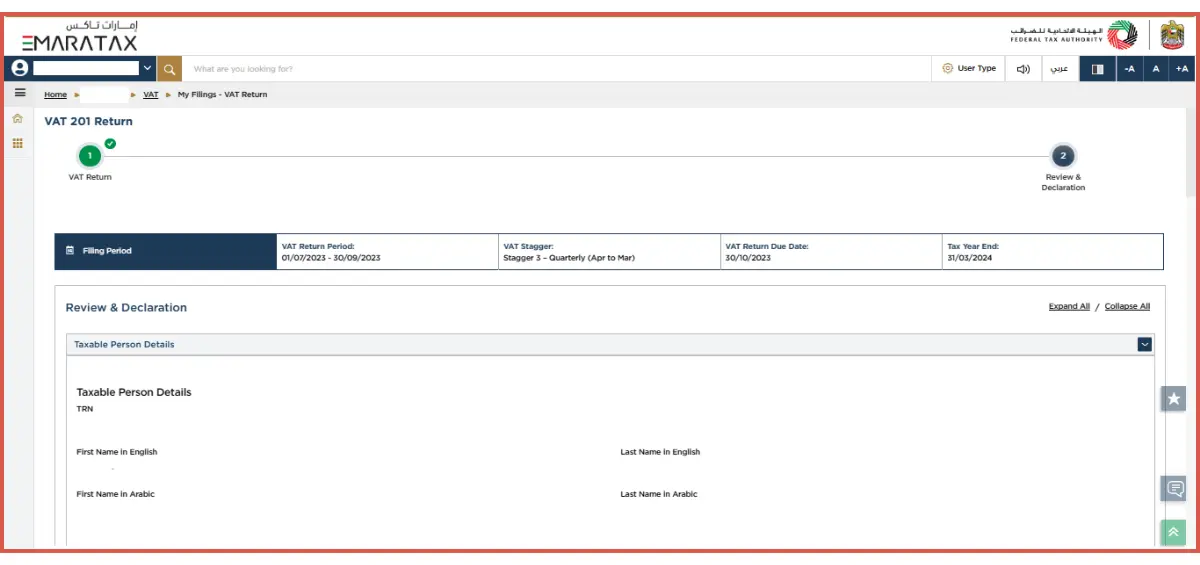

Step 6:

This stage exhibits the submitted data for a final review before submission. Use the ‘Expand All/Collapse All’ option for a section-wise review.

Step 7:

Once scrolled down, the window presents pre-populated declaration details from the VAT registration. Check the provided box and click the ‘Submit’ button to send the VAT return.

Step 8:

Upon successful submission, a confirmation screen will display submission details along with a reference number for future use.

How To Download VAT Return From FTA Portal In UAE?

Post-submission, ensure timely tax payment before the due date. Amendments to the submitted data are permissible until the due date. Additionally, a downloadable copy of the VAT acknowledgment return is available by clicking the ‘Download’ button.

When Are Businesses Required To File VAT Returns?

Businesses subject to VAT regulations are required to routinely submit their VAT returns to the FTA, typically within 28 days following the conclusion of the defined ‘tax period’ specific to each type of business. A ‘tax period’ denotes a specific duration for computing and submitting the relevant taxes. The tax periods are given below:

- For businesses with an annual income exceeding AED 150 million, monthly reporting is mandatory.

- Whereas those with an annual turnover below AED 150 million are expected to submit quarterly reports.

The FTA reserves the right to assign an alternative tax period for specific types of businesses at its discretion.

Penalties For Non-Filing of VAT Returns:

Failure to file a VAT return within the specified timeframe may result in fines in accordance with the regulations outlined in Cabinet Resolution No. 40 of 2017 on Administrative Penalties for Violations of Tax Laws in the UAE. It is crucial to steer clear of substantial penalties, which can vary from AED 1,000 to 3,000 for failure to file or inaccuracies in VAT Returns.

Now Consultant VAT Return Filing Services

Completing VAT returns in the UAE can be difficult without a good understanding. Seeking professional advice is crucial to avoid errors and hefty fines from the Federal Tax Authority (FTA). Now Consultant, an expert audit and accounting firm in UAE, offers FTA-compliant VAT Return Filing in UAE by following the step-by-step process as given above.

If you face challenges filing a VAT return via EmaraTax, consider consulting VAT advisors in UAE like NOW Consultant. Our services cover VAT planning, rule updates, registration, bookkeeping, rate advice, and especially return filing in UAE.

FAQs:

What Are The Eligibility Criteria To File a VAT Return?

Each taxpayer registered for VAT must submit a VAT return in every tax period. The tax period can be a month or a quarter, depending on the prescriptions given by the FTA on the VAT certificate.

Can I File My VAT Return Online?

Yes, you can file for tax return online by accessing the EMARATAX portal. Before you submit the VAT return form on the portal, make sure you have satisfied all the prerequisites for tax returns.

How Long Does It Take To File a VAT Return?

Submit monthly VAT returns by the 28th of the subsequent month or quarterly returns by the 28th day following the end of the quarter. Should these dates align with a weekend or holiday, the deadline is extended to the subsequent business day.