A VAT Certificate is an essential validation of a business’s proper VAT registration issued by the Federal Tax Authority (FTA). It is essential to check the VAT Certificate’s validity and how to do so online through the FTA’s website. The article highlights the role of the FTA in regulating VAT and the benefits of promoting transparency and equitable competition. Moreover, it mentions downloading a VAT Certificate from the FTA portal.

NOW Consultant is the best audit firm in UAE that provides services to simplify the VAT registration process, which is complementary to getting a VAT certificate in compliance with UAE Tax Law.

What is a VAT Certificate?

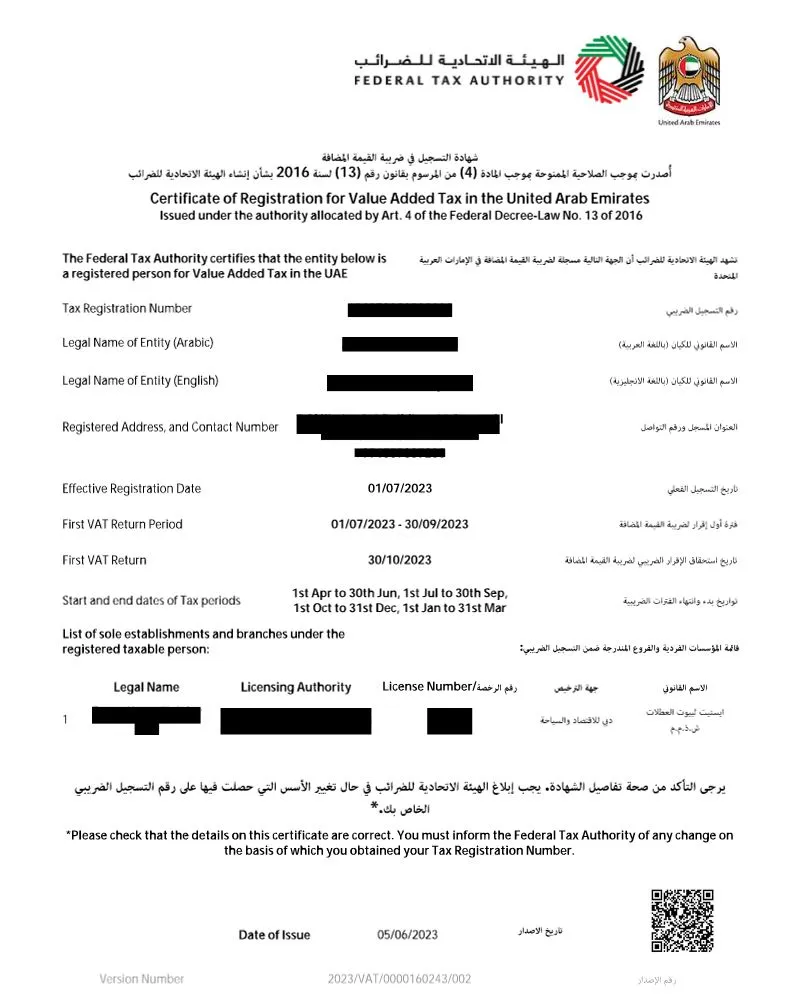

A Value Added Tax (VAT) Certification is an official validation of a business’s proper VAT registration. In the United Arab Emirates (UAE), this certificate is provided by the tax authorities (FTA) and contains vital information about the registered entity. VAT registration linked with a VAT certificate is obligatory for companies and individuals engaging in commercial activities within the UAE.

The UAE VAT Certificate formally acknowledges that a business entity complies with VAT regulations throughout product development. It represents the concluding phase of the VAT registration procedure issued by the Federal Tax Authority (FTA). It has the unique features of an identifier known as the Tax Registration Number (TRN), serving as concrete proof of the entity’s VAT registration status.

The Federal Tax Authority (FTA) in the UAE is the authorized body, the government entity responsible for the administration, collection, and enforcement of federal taxes for collecting and remittance of VAT to the government.

The UAE VAT Certificate substantiates that businesses have adhered to UAE Tax Law regulations, assuring external parties, including customers, suppliers, and service providers, regarding the entity’s official VAT registration status.

How To Check VAT Certificate Online In UAE:

To initiate the process, begin by successfully logging into the VAT section of the FTA website. The supervision of VAT in the United Arab Emirates (UAE) falls under the purview of the Federal Tax Authority (FTA).

They maintain an accessible database containing records of all registered businesses and their corresponding Tax Registration Numbers (TRN). Utilize this resource to search for a company’s VAT certificate by inputting its TRN.

This procedure allows you to validate the authenticity of the VAT registration number. Upon confirming a valid VAT registration number, you will receive details, including the company’s name, the registration date, and its currently registered address.

How To Download VAT Certificate From Emaratax Portal?

To obtain a VAT certificate from the Emaratax portal, you should proceed as outlined below:

- To begin the process, access the EmaraTax portal and log in using your FTA registration credentials, including your registered email and password.

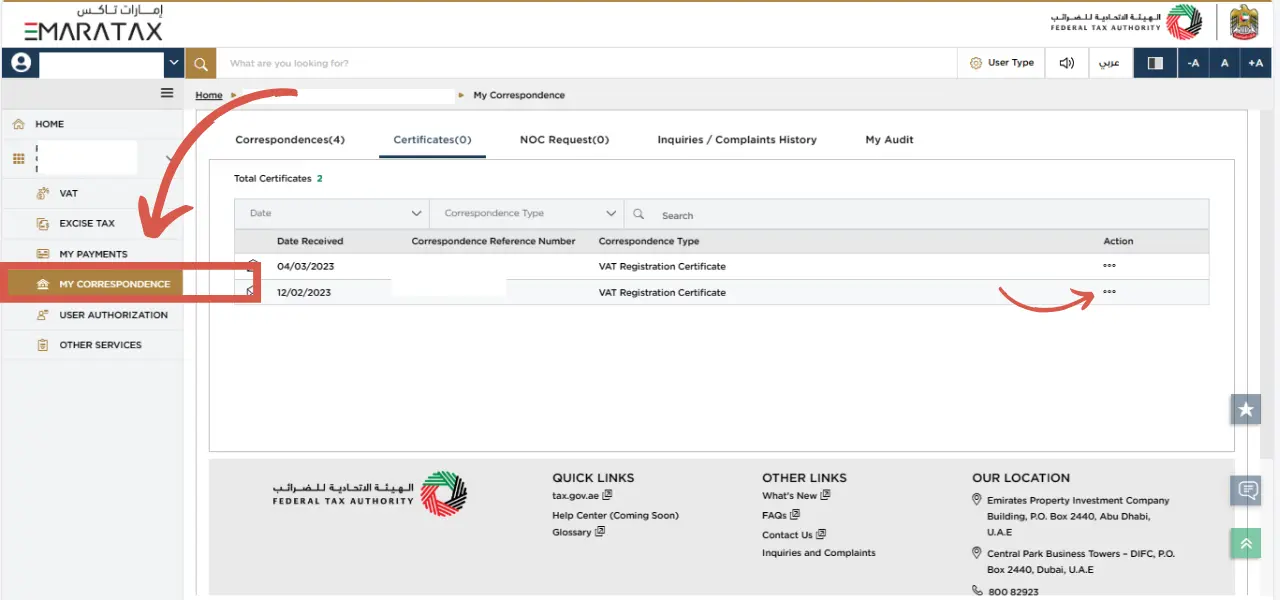

- After logging into your account, navigate to your company’s profile. From there, access the correspondence section to get an option for the certificate.

- To access your VAT certificate, simply click on the “Certificates” tab. From there, you’ll be able to view and download your VAT certificate by clicking on three dots as marked in the screenshot.

FAQs:

Is VAT Certificate Mandatory In UAE?

Businesses in the UAE must register for VAT in order to obtain VAT certificate if their annual supplies in member states exceed AED 375,000 or if they anticipate crossing this threshold in the next 30 days.

Is VAT Ceretificate Amendable?

Yes, a VAT certificate can usually be amended, especially in cases where there are changes in the local office or the addition of partners. To initiate such changes, you typically need to submit an amendment request application through the official website of the relevant tax authority in UAE, such as the FTA (Federal Tax Authority).