The Tax Registration Number (TRN) is a distinct 15-digit code obtained when a company undergoes the Value Added Tax (VAT) registration process in UAE. TRN comes into play with VAT, a tax borne by consumers. It serves as a means to distinguish a business from others. In the UAE, every company is mandated to register for a TRN.

It’s a code of paramount significance for active businesses in Dubai. While Value Added Tax (VAT) is a consumer-based tax, the TRN sets your business apart for tax payments and VAT obligations. This ensures that tax authorities can easily identify the company for tax payments and VAT-related matters Interestingly, even if your company has multiple activities or branches, it will have only one TRN.

Importance of Having a TRN Number In UAE

The TRN serves as a unique tag for your entity in the eyes of the Federal Tax Authority (FTA). If you’re a “Registrant,” the entity to whom the TRN is issued, it’s imperative to include this number in various government-mandated documents such as VAT Return Filing, Tax Invoices, and Tax Credit Notes.

The significance of possessing a TRN (Tax Registration Number) in the UAE lies in its role as a 15-digit identifier. This number allows the Federal Tax Authority to distinguish you from others. Those to whom the TRN is issued, known as “Registrants,” are required to include this number in various government-mandated documents like VAT Return Filing, Tax Invoices, and Tax Credit Notes.

Having a TRN is a mandatory prerequisite for engaging in VAT transactions. The Federal Tax Authority necessitates specific invoice elements, notably the Value Added Tax (VAT) amount and the company’s Tax Registration Number (TRN). In line with UAE’s VAT regulations, such invoices are termed ‘Tax Invoices.’

A tax invoice in the UAE must include the company’s name, address, a unique invoice number, and the TRN. Without these elements, VAT payment is not required.

Non-compliance with these requirements means businesses cannot charge VAT. This adherence to the VAT law in the UAE ensures accurate tax handling.

Who Is Eligible For a TRN In The UAE?

Understanding who can obtain a TRN is vital. Every company in the UAE has to follow the rules set by the government, including those related to VAT. Companies must meet specific revenue requirements to be eligible for VAT registration and a TRN in the UAE.

1. Voluntary Registration

For voluntary registration, the threshold is 187,500 AED. If your company earns an amount between 187,000 AED and 375,000 AED, you have the option to sign up for VAT. VAT registration is not mandatory if your revenue is lower than 187,500 AED.

2. Mandatory Registration

Mandatory registration kicks in at approximately 375,000 AED. If your business’s revenue is expected to exceed this threshold in the next month or has exceeded it in the past 12 months, you must register for Value Added Tax to avoid fines and penalties.

How to Apply for TRN in UAE – Step By Step Process

Now that we’ve clarified eligibility let’s discuss obtaining a TRN. This step is very important to follow different tax rules like VAT, Excise, or Corporate Tax. Here’s a step-by-step guide:

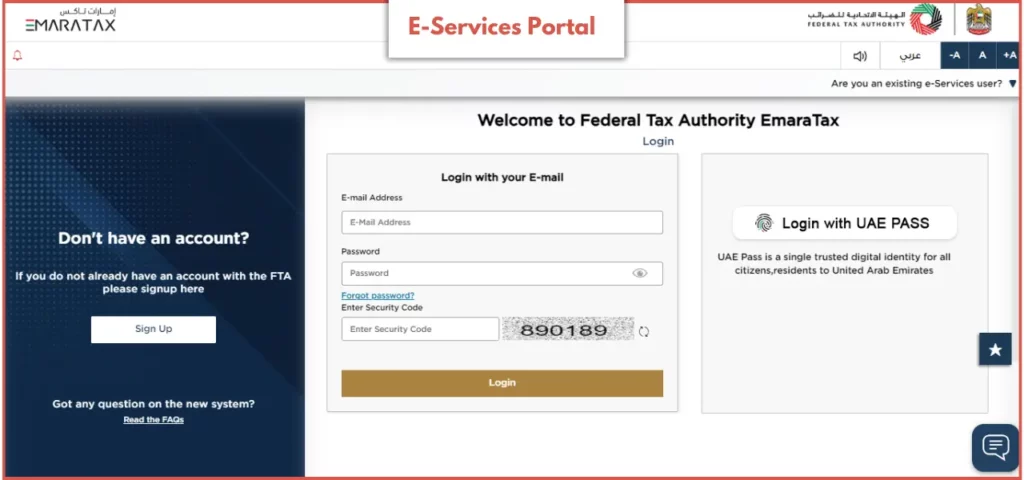

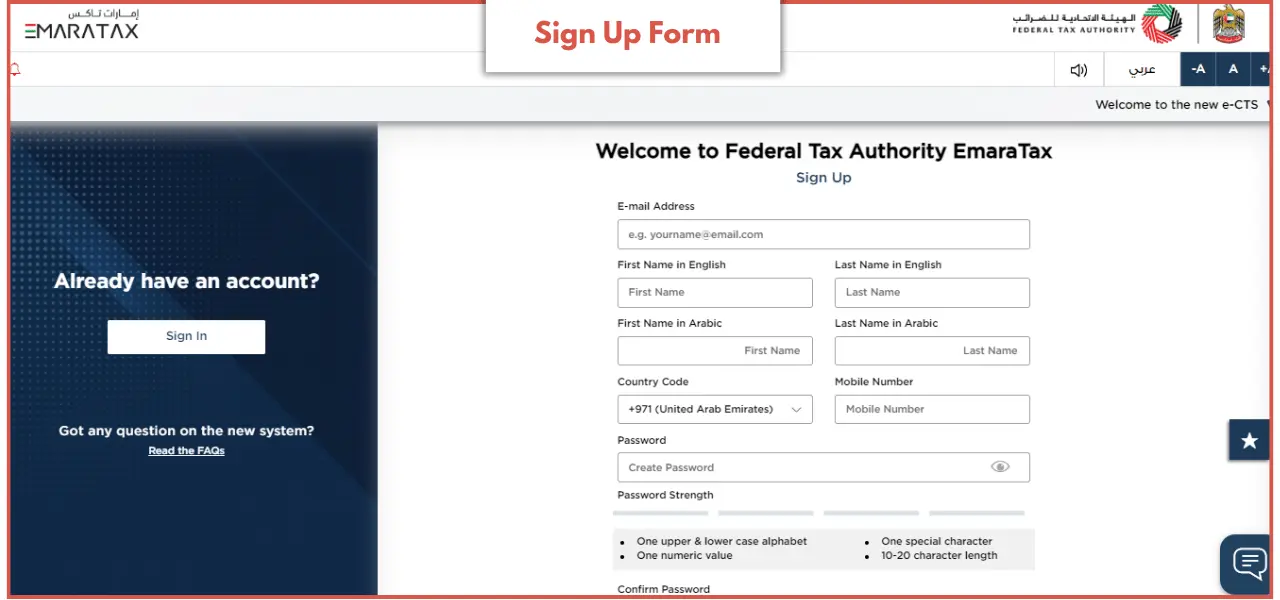

1. Setting Up Your e-Service Account

Initiating your TRN application begins with the creation of an e-Service account. Think of it as akin to setting up any other online account, Gmail or Yahoo. Here’s a straightforward breakdown:

- Visit the official FTA e-Service Website.

- Here, you will find a ‘Sign up’ option at the left side of the page.

- Click on the ‘Sign up’ and complete the process by filling in the requisite information. This includes your email ID, the creation of a password, the entry of a security code, and the selection of a security question.

- After completing the sign-up form, you’ll receive a verification email at the provided address.

- Utilizing your newly created credentials (User Name and password), you can now access your e-Service account.

2. Beginning the VAT Registration Process

With your e-Service account established, it’s time to initiate the VAT registration process. Here’s a systematic guide to aid you in applying for VAT registration in the UAE:

- Access your e-Service account using your login credentials.

Document Checklist: Prior to commencing the process, ensure you have all the necessary documents for VAT registration in the UAE.

3. Accessing Your VAT Registration

Once you’ve logged into your e-Service account, you’ll immediately spot the ‘Register for VAT’ option on your dashboard. This marks the official commencement of the VAT registration process.

4. Exploring the VAT Getting Started Guide

Upon selecting ‘Register for VAT,’ you’ll be directed to the ‘Getting Started Guide.’ This helpful guide is here to make it easier for you to grasp how to register for VAT in the UAE. You will find all the essential information to complete the VAT registration form here.

As you progress through the various sections of the guide, make sure to check the box confirming your thorough perusal of the guide. Subsequently, click ‘Proceed’ to advance to the subsequent stages.

5. Filling Out the VAT Registration Application

After reviewing and confirming the guide, you’ll proceed to the VAT registration application form. This is where you’ll provide all the pertinent details for your VAT registration. The online form comprises eight sections that necessitate completion for comprehensive VAT registration.

To facilitate progress tracking, the portal employs color indicators. Sections under development or with pending details are denoted in ‘Brown,’ while sections that have been successfully filled out are marked ‘Green’ with a checkmark.

Here’s a pivotal tip: Advancement to subsequent sections is contingent upon completing all mandatory fields, typically identified by a red asterisk (*). The omission of mandatory details will prompt a notification from the portal specifying the fields requiring attention.

Navigating the VAT registration process in the UAE becomes a straightforward endeavor when adhering to these guidelines. Ensure your documents are well-prepared, carefully review the guide, and provide precise information within the application form.

The Tax Registration Number (TRN) in UAE is a unique identifier assigned to businesses and individuals for tax purposes. Understanding its validity is crucial, especially for transactions. Using our step-by-step guide, you can verify a TRN in UAE with accuracy and compliance.

FAQs:

Do We Need TRN In UAE For Cash Sale?

Indeed, a Tax Registration Number (TRN) is a prerequisite for all transactions in the UAE, including cash sales. It is obligatory to ensure businesses’ compliance with tax regulations, specifically Value Added Tax (VAT).

How Many Digits Is The TRN Number In UAE?

The UAE’s TRN (Tax Registration Number) comprises a unique 15-digit sequence. This extensive number is pivotal in distinguishing businesses and overseeing tax-related transactions.

How Do You Cancel The TRN Number In UAE?

The procedure for canceling a TRN number in the UAE generally involves contacting the relevant authorities, notably the Federal Tax Authority (FTA). The cancellation process should be meticulously followed, which may encompass settling any outstanding tax liabilities.

Seeking counsel from tax experts or legal advisors is advisable to ensure proper adherence to the cancellation process.

How Now Consultant Helps You Get a TRN Number in UAE?

Applying for tax registration number in uae can be challenging. That’s where Now Consultant comes in. We are a trusted tax consultancy experts dedicated to helping you ensure compliance with UAE laws and grow your business seamlessly. Our team comprises experienced tax specialists, and business experts who understand the nuances of the UAE’s regulatory landscape.

We provide real-time assistance on tax, finance, and business operations, guiding you through the UAE’s legal tax requirements. Contact us for any queries and problems you face applying for TRN In UAE.