In the UAE, VAT registration has been a critical task for businesses since its implementation in 2018. If your turnover exceeds AED 375,000, you must register, and if changes in registration credentials occur, amendments should be reported to the Federal Tax Authority (FTA) within 20 days.

The process involves notifying the FTA in writing, awaiting approval, and modifying details online, such as business info: address, bank details, and declarations. Notably, some fields cannot be directly changed. Failure to report changes promptly may result in penalties, starting at AED 5,000.

Now Consultant, a top audit firm, provides VAT consultancy services, ensuring a professional and cost-effective approach for businesses in the UAE.

Process To Amend VAT Registration in UAE

The following is a brief explanation of amending VAT registration in UAE:

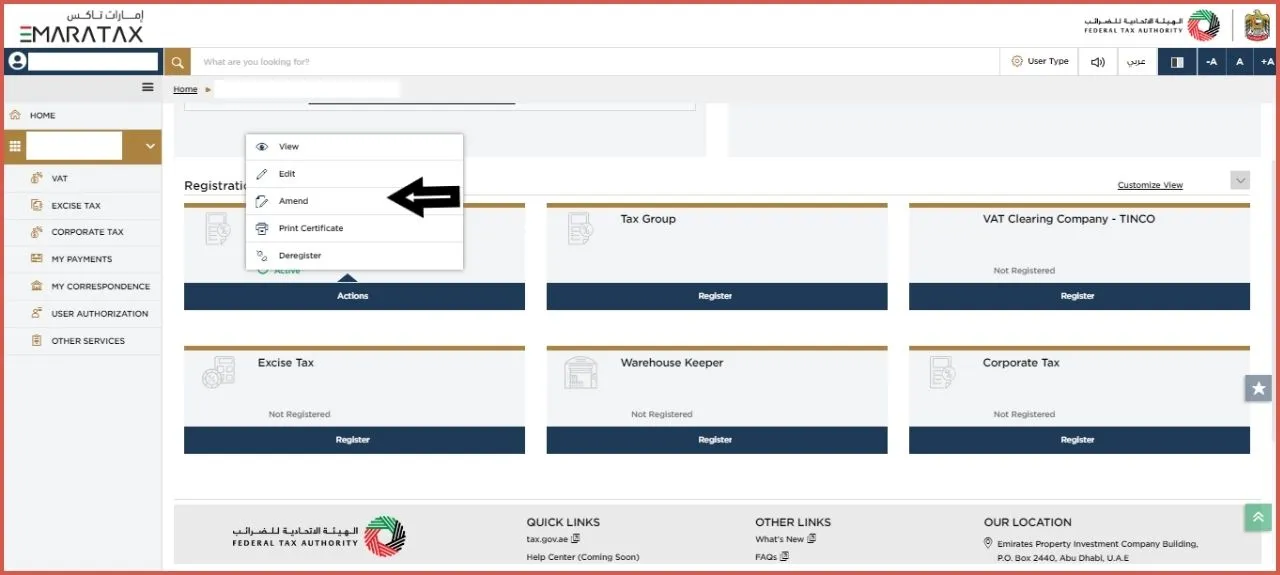

- Go To FTA Online Portal.

- Select Your Submitted VAT Registration Application and click on “Amend”.

- Adjust your “Entity Details“.

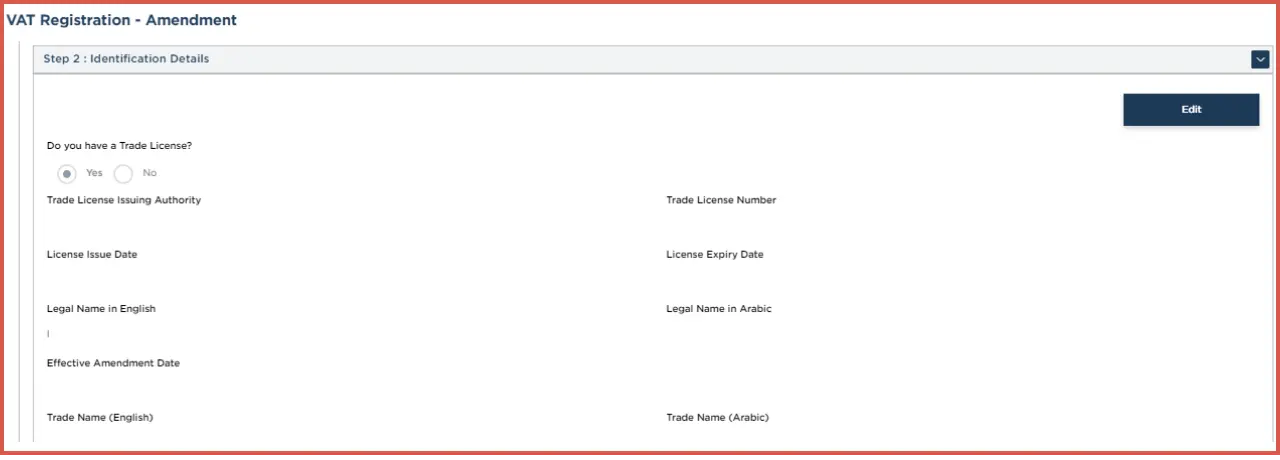

- Modify the “Identification Details” if needed.

- Update “Business Activity” information in the VAT application.

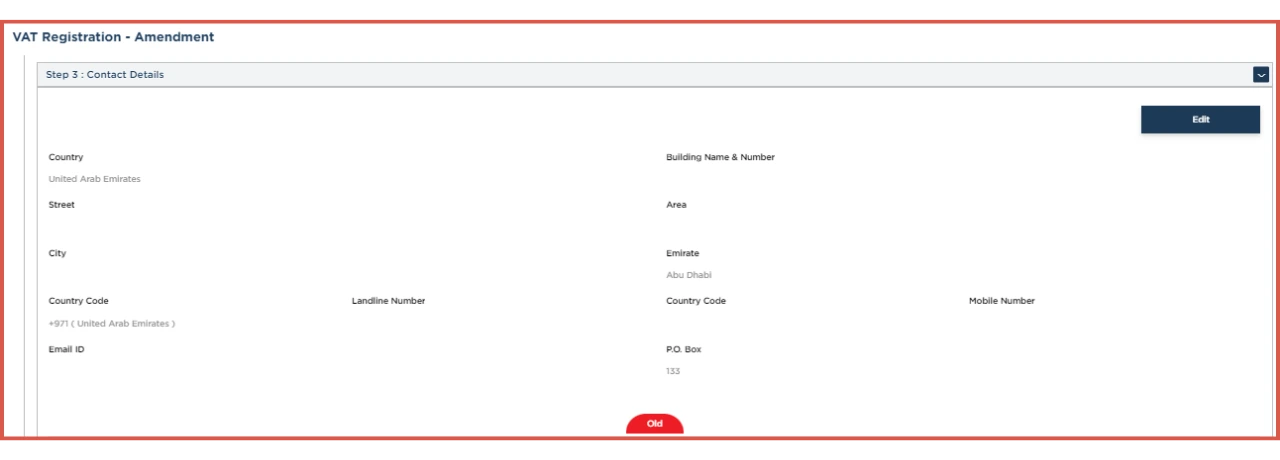

- Revise “Contact Details“.

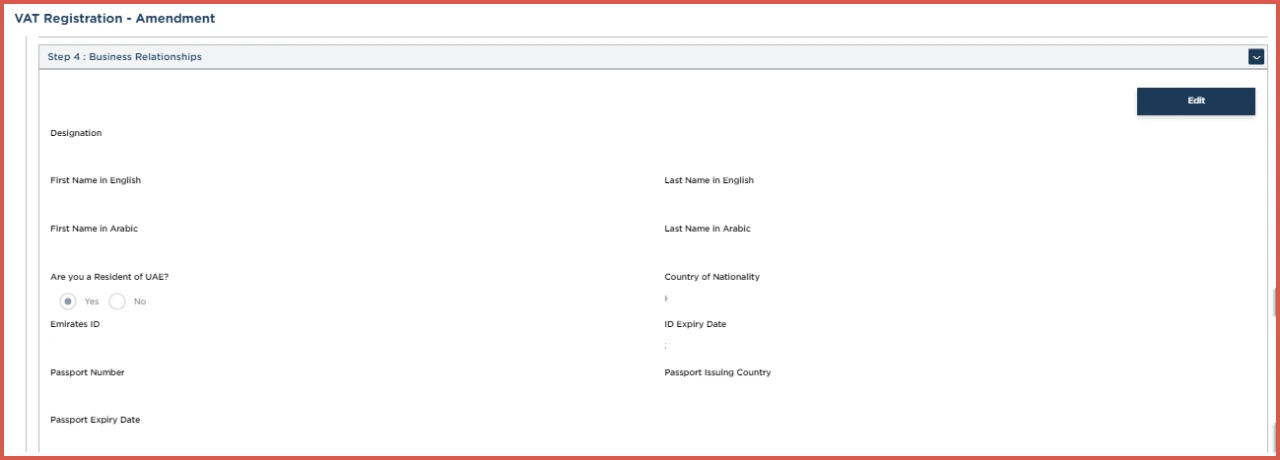

- Modify “Business Relations“.

- Amend actual or estimated financial transactions after approval.

- Revise import and export details post-approval.

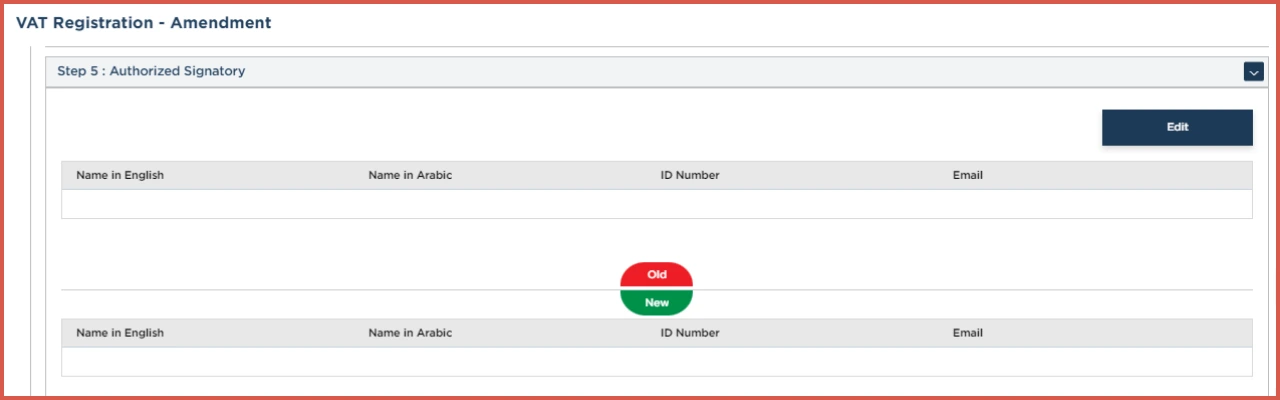

- Make changes to “Authorized Signatory” or communication preferences.

- Double-check all amended details for accuracy before clicking ‘review and submit.‘

Fields That Are Prohibited From Amendments:

The following specific fields are not directly amendable:

- In the ‘About the VAT application’ section, it is not allowed to modify the ‘Exception from VAT registration directly.

- In the Declaration section, direct modification of the ‘Notification language change’ field is impossible.

- The Communication preference section is also not directly amendable by the firm.

Firms registered for VAT must ensure timely notification to the Federal Tax Authority of any changes or updates. Failure to do so may result in penalties, starting at AED 5000 for the first offense and increasing to AED 15000 for subsequent violations. To avoid penalties, all businesses must familiarize with the VAT registration process and the procedure for amending VAT registration in the UAE.

Now Consultant Services :

To amend VAT registration in UAE, expert guidance means a lot for accurately following the above due process. Now Consultant, the best tax consultant in dubai can help you throughout the amendment process. Now Consultant is recognized for delivering personalized services to its clients.

Moreover, we also offers accounting, auditing, and bookkeeping services to businesses in the UAE. The tailored services ensure a cost-effective and professional approach to addressing the diverse challenges businesses face.

FAQs:

What Is An Amended VAT Return?

An amended VAT return is a revised version of a previously submitted VAT (Value Added Tax) return. In situations where errors, omissions, or inaccuracies are discovered in an original VAT return after it has been filed with the tax authorities

How To Amend Company Information In VAT?

To amend company information in VAT, follow these steps:

1. Go to the online portal provided by the FTA for VAT registration.

2. Find your authorized registration application within the Dashboard section.

3. Click ‘Edit’ to update the required details.

Is There Any Fine For Amendment In UAE VAT?

Yes, if a registered firm fails to notify the FTA of updates, the firm faces a penalty of AED 5000 for the first instance, increasing to AED 15000 for repeated failures to notify the Federal Tax Authority of changes.