VAT is a form of indirect tax imposed on buying goods and services. Since its inception in 2018, VAT has emerged as a crucial component of the tax system in the UAE. For businesses in the UAE, understanding the VAT registration procedure is crucial for maintaining compliance and smooth operations.

This article aims to simplify the VAT registration process by defining the eligibility criteria, the necessary steps, and the requirements for successful registration.

The UAE’s Federal Tax Authority (FTA) aligns taxable supplies to streamline the VAT registration method. As a 5% tax on goods and services, businesses are legally obligated to collect VAT on behalf of the government at the point of sale, emphasizing the necessity for businesses in the UAE to ensure their registration for VAT compliance.

Eligibility Criteria For VAT Registration

The following criteria apply to companies eligible for VAT registration:

1. Voluntary VAT Registration :

The voluntary VAT registration applies to businesses earning annual profits between AED 187,500 and 375,000. If your company falls within this range, you can opt for voluntary VAT registration and obtain a Tax Registration Number.

Additionally, voluntary VAT registration is required if you anticipate that your company’s turnover in the next thirty days will exceed AED 187,500.

2. Compulsory VAT Registration:

Companies that have an annual turnover exceeding AED 375,000 have compulsory VAT registration. Obtaining the Tax Registration Number (TRN) is essential for the smooth operation of your business, not only in this emirate but in all other emirates.

3. Exempt from VAT Registration:

Supplies valued below 187,500 AED would be exempted from VAT registration.

Process To Register Your Company For VAT In UAE:

To register for VAT, access the FTA website. First, you must set up an FTA e-service portal account. Once logged in, access the online VAT registration form, which comprises 8 sections where all required details must be provided for a comprehensive VAT registration.

1. Entity Details:

Choose your business’s Entity type from the list, noting that input fields may vary based on the selected entity type.

- Save your application as a draft for future reference.

- After completing the mandatory fields, click “Next Step” to save and move to the Identification Details section.

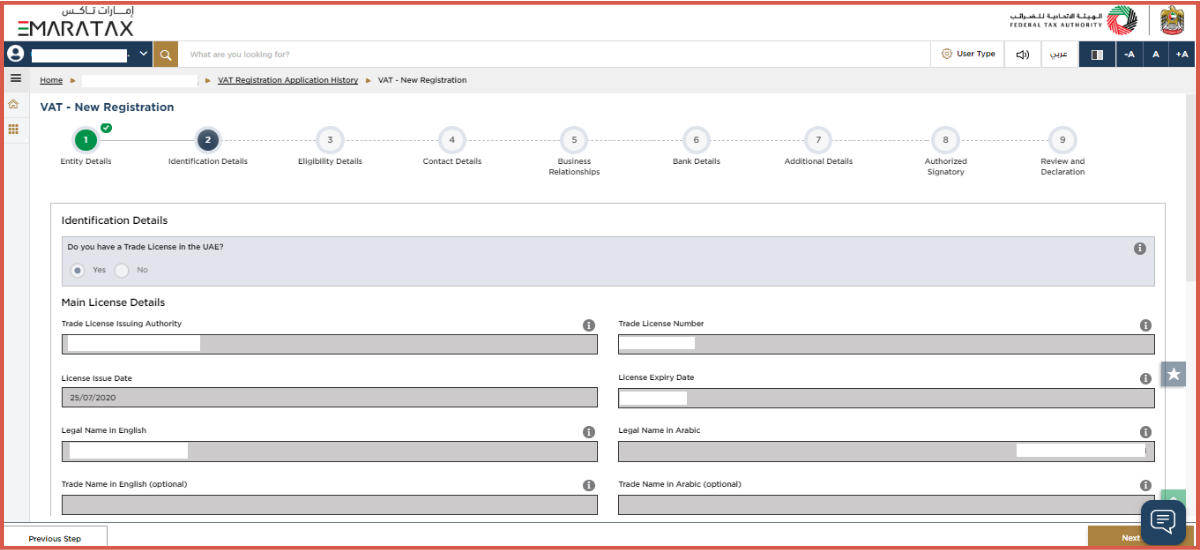

2. Add Identification Details:

The next step is entering your identification details, according to your Entity Type, and providing essential details from the main Trade License.

- Please input the necessary business activity details and select Add.

- Ensure to provide comprehensive information about business activities.

- Add business activities, owners, and branch details if needed.

- VAT registration is for the head office, not for the branches.

- Once the License form is complete, click “Next Step” to proceed.

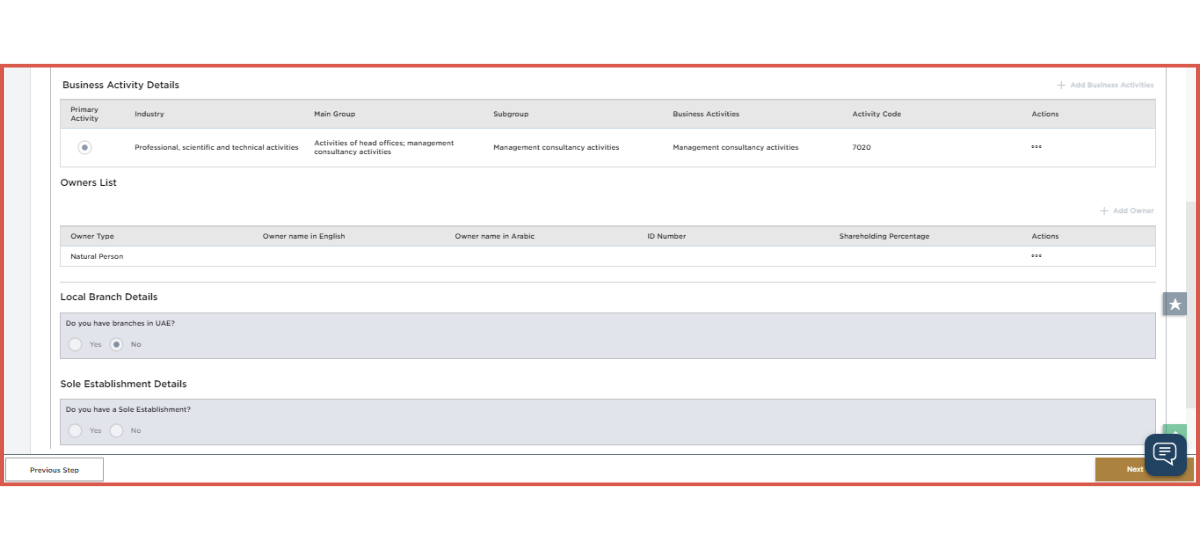

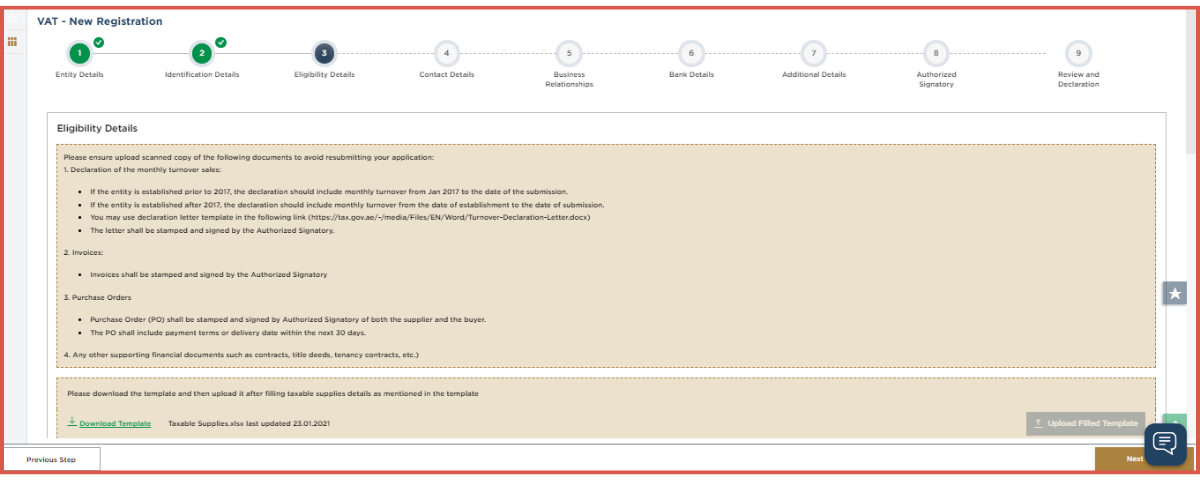

3. Add VAT Registration Eligibility Details:

You have options to input taxable supplies and expenses. Download an Excel template, fill in and upload the details, or directly input the taxable goods and expenses on the screen. If you meet Mandatory or Voluntary VAT criteria, you’re eligible for registration; if the criteria don’t apply, you won’t be eligible.

4. Update Contact Details:

Enter your business’s registered address, ensuring it’s not another company’s address. For multiple addresses, provide where most daily business activities occur. Foreign businesses registering for UAE VAT need to appoint a UAE tax agent.

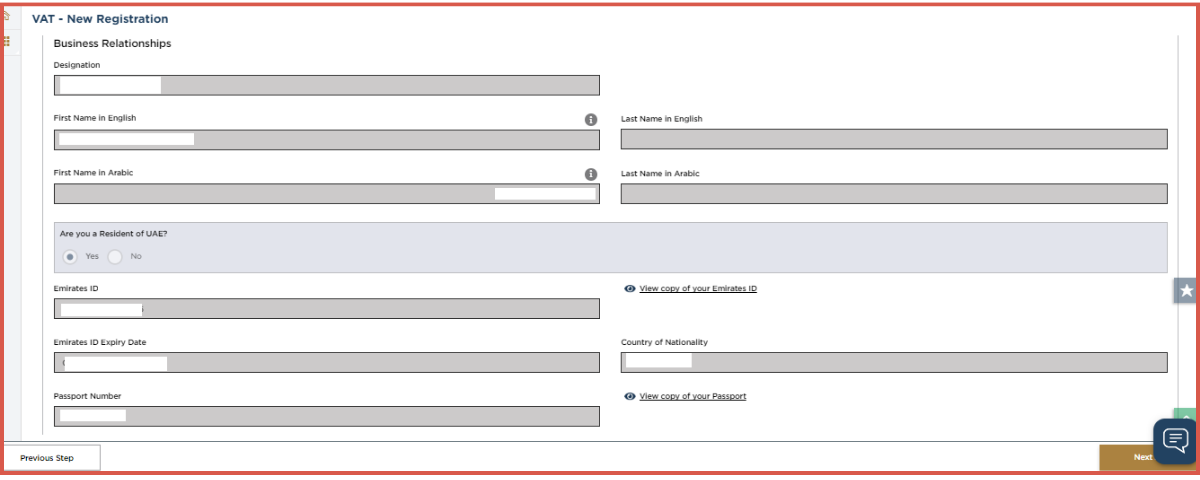

5. Add Business Relationships

Enter the Manager or CEO’s details. To incorporate additional relationships, select “Add Relationships.” Include optional Partner/Director details by clicking “Add.” Once the required fields are filled, proceed to the Bank Details section by clicking “Next Step.”

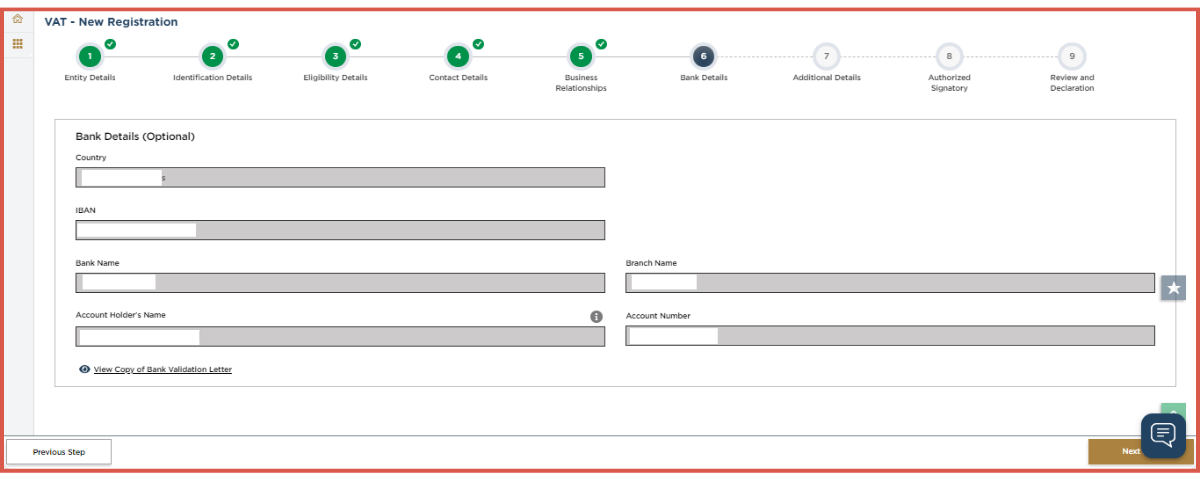

6. Include Bank Information:

Bank details are mandatory for VAT registration; it’s highly recommended to provide them to prevent delays in refund processing. Verify the account details for electronic payments’ suitability.

- If opening a new account, provide relevant correspondence.

- Ensure the account name matches your entity’s legal name.

- Also, fill in additional details in Step 7.

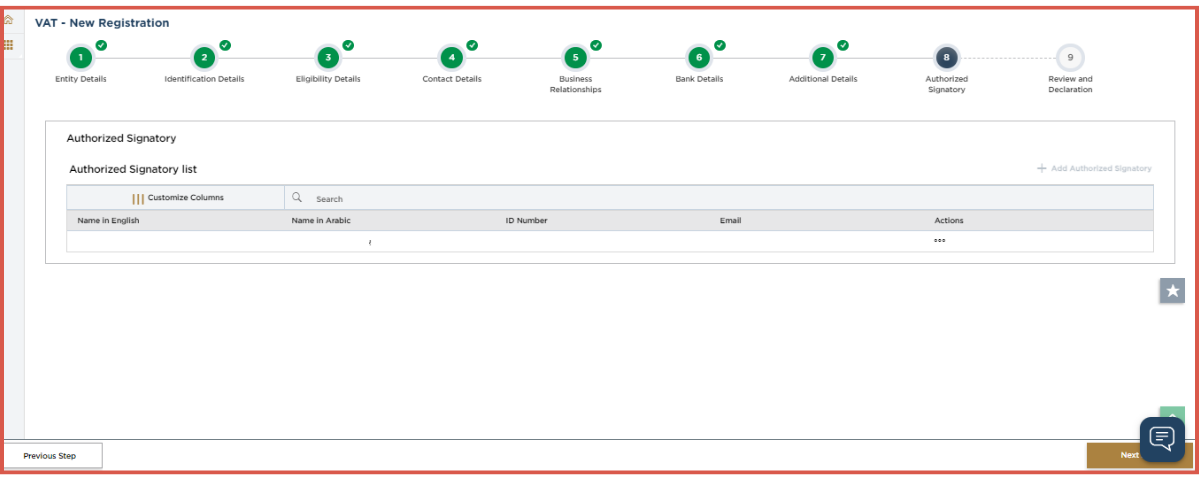

7. Submit to the Authorized Signatory

Select “Add Authorized Signatory” to input the pertinent authorized details. If the Manager or CEO serves as the authorized signatory.

- Choose “Yes” to utilize business relationship details.

- Otherwise, opt for “No” to input distinct authorized signatory information.

- Upon completing the fields, click “Add”

Note: Validation might require Power of Attorney details for legal persons. Add more authorized signatories if needed.

8. Review & Declaration

In this section, the application details are outlined. You should thoroughly review and then apply. After careful review, check the accuracy declaration checkbox, and then click “Submit” to send the VAT Registration application.

Documents Required For VAT Registration In UAE

For VAT registration in the UAE, businesses need to furnish the necessary documents, and the registration process, along with fee submission, is carried out online. The following are the required documents for VAT registration in the UAE:

- Current and valid Trade License copy.

- Unexpired Passport copies of the owner/partners listed on the license.

- Valid Emirates ID copies of the owner/partners listed on the license.

- A Memorandum of Association (MOA) is not necessary for sole establishments.

- Provide the full contact information for the company, including the address and P.O. Box.

- Share the contact details of the person in charge, including their phone number and email.

- Provide your banking details, the account number, account name, bank name, branch name, and IBAN.

- Submit a statement of your business turnover for the last 12 months. Make sure it is signed, stamped, and printed on your company letterhead.

- Evidence if the business engages in import and export activities.

- Confirmation if the business interacts with any customs department – if yes, provide the VAT Registration Letter.

VAT Registration Penalties

Late VAT Registration:

If a person or business has made over AED 375,000 in the past year, they are required to register for VAT within 30 days of reaching this income threshold. The Federal Tax Authority (FTA) will assess each registration application and impose a fine of AED 10,000, according to Cabinet Decision No. 49 of 2021, for late applications.

Furthermore, as per Article 7 of Federal Decree-Law No. 8 of 2017, if a taxable entity fails to apply for VAT registration on time, it must pay taxes for all supplies and imports made before the registration.

Non-Compliance of VAT:

Any producer of goods and services whose taxable supplies and imports exceed AED 375,000 must register in compliance with Federal Decree-Law No. (8) of 2017. Failure to register with the FTA incurs a penalty of AED 20,000.

How We Can Help You In VAT Registration?

NOW Consultant is a prominent consultancy firm in the UAE specializing in expert services for businesses in VAT registration. We offer VAT services for all types of businesses in the UAE, delivering a complete and authentic process for VAT registration in compliance with FTA regulations.

Our expert team can save your company from a hefty fine for noncompliance with VAT registration in the UAE.

FAQs:

Is a Bank Account Mandatory For VAT Registration In The UAE?

Certainly, having a bank account in the UAE is mandatory. The account should be in the same name as the entity being registered with the FTA. Make sure the account has essential details like IBAN, BIC, the Bank’s Name, the Account Holder’s Name, and that the currency is AED.

What Is The Exception For VAT Registration In The UAE?

As per Clause 1, Article 15 of the revised VAT Law, the Federal Tax Authority (FTA) can exempt a Taxable Person from VAT registration if their supplies are solely at zero rates. If registered individuals only deal with supplies that have zero VAT, or if they no longer have any supplies except those with zero VAT, they can request an exemption from VAT registration.

How Long Does It Take To Get VAT Registered In UAE?

The process to get VAT registered in the UAE typically takes around 20 working days, subject to the completion of required documentation and verification by the authorities.

Does The VAT Registration Process For New Companies In The UAE Different?

The VAT registration process for a new company in the UAE follows similar steps as for existing companies. However new companies can also register for VAT if they cross the voluntary threshold which is 187500 AED.