To prevent any financial crime, the law enforcement team and the financial institutions must work together to execute regulations and promote teamwork with the help of technology.

Any illegal behavior that involves the exploitation of financial systems, institutions, or tools for malicious ends, frequently to generate profits for the offenders, is referred to as financial crime. If proper steps are not taken, financial crimes pose a major risk to any organizations operating both internationally and within the Gulf Cooperation Council (GCC). The world economy and society are under increasing threat from financial crimes. Regulators are always coming up with new ways to combat them, but outlaws are also constantly enhancing their techniques.

The Significance of Financial Crime Prevention:

Financial crime risk is greater than ever before as the globe becomes more connected and digitized. With the help of safety and risk management frameworks in place, you can easily prevent financial crimes. With the help of these frameworks, organizations can recognize and evaluate the possible dangers and work towards taking the appropriate actions. AI systems can alert businesses to potential hazards by examining patterns and trends in financial transactions, enabling them to respond quickly to stop financial fraud.

Financial crime prevention demands a strong culture of ethical behavior and responsibility in addition to technology and compliance structures. Organizations can help prevent financial crimes and build a more reliable financial system with the help of enforcing transparency, integrity, and responsible behaviors within the organizational hierarchy.

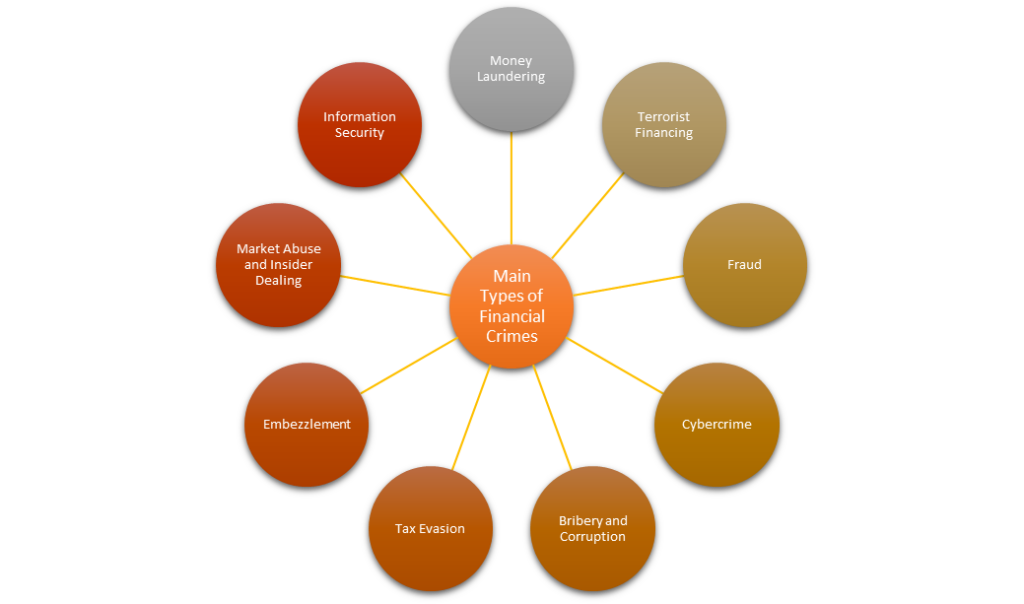

Types of Financial Crimes:

Strategies for Effective Financial Crime Prevention:

GCC businesses face increasing difficulties in preventing financial crime and other types of fraud. Fraudsters continually improve their methods and search for flaws in procedures. This is why organizations need to stay up-to-date with the current regulations and monitor the potential of money laundering by constantly monitoring and keeping up with the developments. 5 measures to help stop financial crime are:

Establish Effective Internal Controls:

The prevention of financial crime requires the establishment of effective internal controls. This may involve steps taken to confirm clients’ identities, keep an eye on transactions for any suspicious behavior, and identify and report any atypical or suspicious activities.

Conduct Frequent Risk Analysis:

Organizations can detect possible financial crime risks and take the necessary precautions by conducting regular risk assessments. This may involve finding clients or business partners who pose a high risk, as well as putting additional controls and due diligence procedures in place.

Provide financial crime prevention training and education:

Prevention of financial crime requires training and knowledge. Employees should be trained regarding corporate policies and regulations.

Implementing strong Know Your Customer (KYC), Know Your Business (KYB), and Anti-Money Laundering (AML) policies:

Organizations can detect possible risks and take the necessary precautions to prevent financial crime by using strong KYC, KYB, and AML procedures. These regulations may help preserve the organization’s credibility and prevent financial losses brought on by forgery or other criminal activity.

Foster a culture of compliance and heighten its importance:

The key to preventing financial crime is to promote a compliance-oriented culture. This involves creating an atmosphere where staff members are encouraged to report suspicious conduct without fear of retaliation and where adherence to laws and internal procedures is prioritized throughout all businesses.

The UAE seeks to improve its AML/CFT capabilities, guarantee the integrity of its financial sector, and contribute to the global fight against financial crime by collaborating with foreign partners and exchanging best practices. The path to success is made easier with the comprehensive business solutions provided by Now Consultant. By creating appropriate regulation and communication strategies and implementing practical solutions, Now Consultant can assist you in creating a more compliance-focused culture. To follow the AML policy, we have a team and an effective system. Our consultants are accustomed to abiding by local regulations and have established working connections with area regulators.

Challenges for GCC Businesses:

The issue of money laundering is common, but it has been a significant challenge for Gulf countries in particular since over the years, various institutions in the UAE alone have failed to carry out the essential security checks to prevent money laundering and the financing of terrorism.

Constant watchfulness and stringent security procedures are needed to keep customers and businesses secure from financial crimes, such as:

- Know Your Customer (KYC)

- Customer Due Diligence (CDD)

- Anti-Money Laundering (AML)

- Countering the financing of terrorism (CFT)

The UAE Ministry of Economy’s anti-money laundering law, which went into force in 2018, was the first significant initiative. Federal Decree No. 20 was delayed to be implemented by businesses and individuals, but this was followed by a crackdown. A list of 26 cases involving money laundering offenses with fines ranging from Dhs50,000 to Dhs1 million each was published by the MoE in 2021.