Intro:

Deregistering for VAT in the UAE involves a business canceling its VAT registration with the Federal Tax Authority (FTA). This article helps businesses with the VAT cancellation process, emphasizing the need to follow specific rules and procedures to avoid FTA rejection and fines. It highlights the importance of understanding regulations, using the EmaraTax portal, and meeting eligibility criteria and deadlines.

Understanding the rules and processes for VAT annulment is crucial for taxable businesses to avoid administrative penalties.

What is VAT De-registration?

VAT deregistration is the process of canceling VAT registration by a taxable person. Upon receiving the application, the FTA revokes the VAT registration.

Who Can Deregister For VAT? ( Eligibility)

As a taxable entity, requesting VAT deregistration within 20 business days if your business ceases activities related to VAT supplies is essential. There are specific situations that prompt an individual or business to apply for VAT deregistration:

- The business or taxable person doesn’t produce taxable products and doesn’t anticipate doing so for the next 12 months.

- The business or individual continues production, but the value over the past 12 months is below the Voluntary Registration threshold of AED 187,500.

- The business or individual produces taxable products, but the value over the previous 12 months was below the Mandatory Registration threshold of AED 375,000, and 12 months have passed since the voluntary registration date.

How To De-register for VAT in UAE (process):

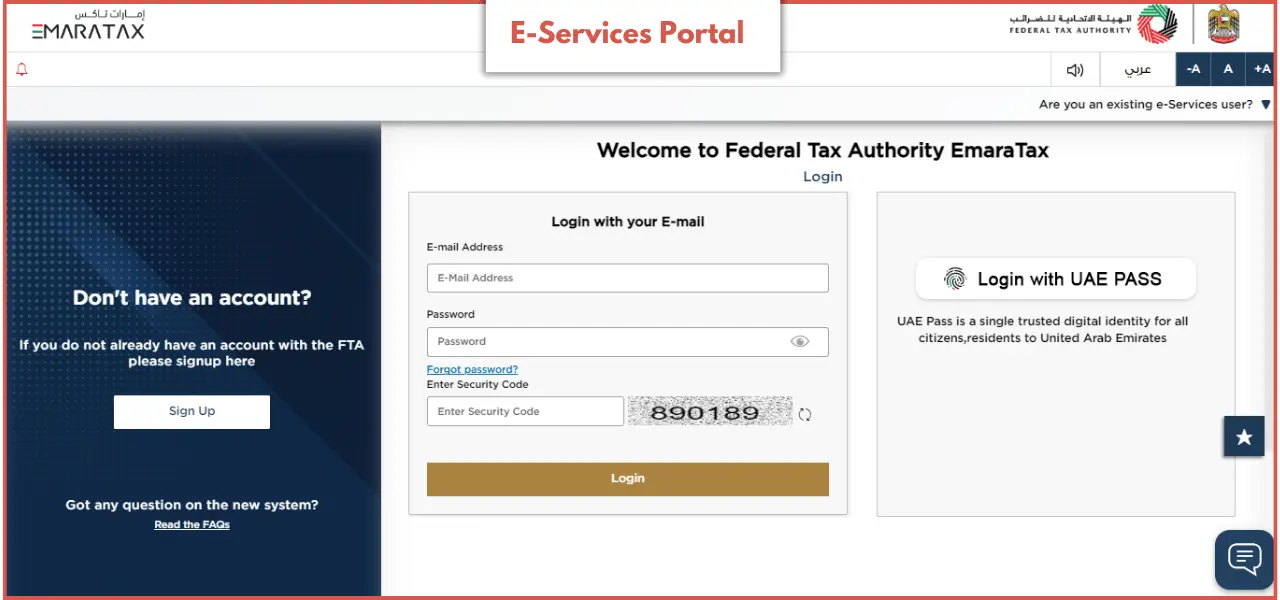

Login Using Your Credentials:

To begin the VAT deregistration process, log in to your EmaraTax account. Log in to your EmaraTax dashboard using your credentials. New users can register by clicking the Sign up” button. You will be directed to the EmaraTax online user dashboard upon logging in.

For users with 2-factor authentication, input the OTP received in your registered email and mobile number to log in, which will redirect you to the EmaraTax dashboard upon successful authentication.

1. Choose Your Company On The EmaraTax Dashboard:

Upon accessing the EmaraTax dashboard, you will find the Taxable Person list, consisting of profiles linked to your records. Choose a Taxable Person and click ‘View’ to access the dashboard. You’ll need to create the one if there’s no linked Taxable Person. You’ll need to create the one if you missed or forgot the login access.

2. Choose ‘De-register’ Within The VAT Tile:

To initiate the VAT deregistration application, click on ‘Actions’ within the VAT tile32 and choose ‘Deregister.’

3. Update Details and Proceed

Select ‘Edit/Review’ to make changes to your bank details before entering the deregistration application. Alternatively, choose ‘Proceed to De-Registration’ to directly access the VAT deregistration application. Ensure you have all necessary documents for VAT deregistration in the UAE, then accept. Ultimately, select ‘start’ to commence the process of deregistration.

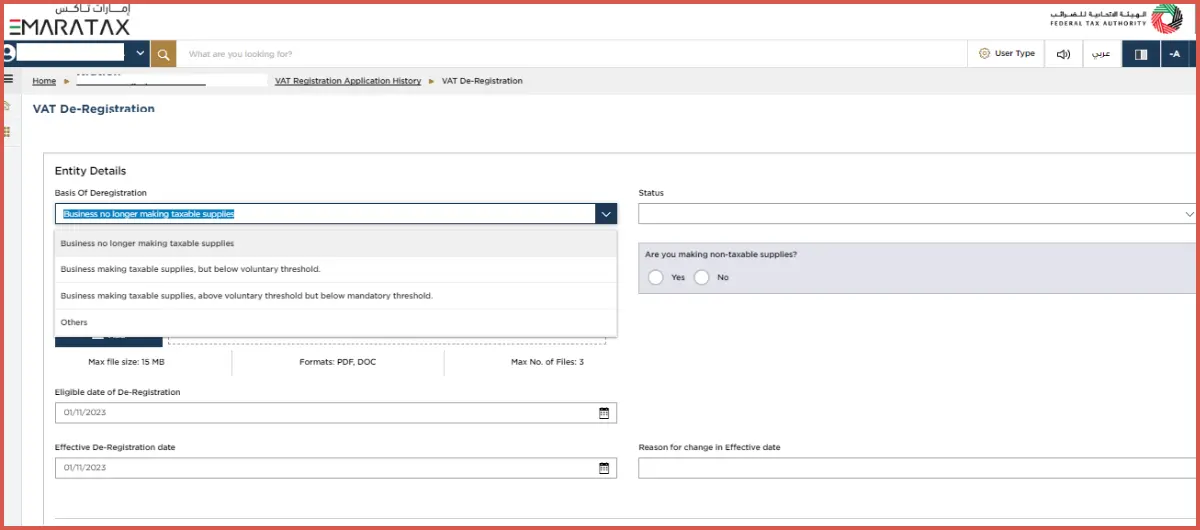

4. Complete and Submit The Necessary Information and Documents

- Input the necessary information and upload documents in approved formats, ensuring all application fields are completed.

- Include supporting documents within the application to prevent potential rejection or the need for resubmission later.

- Certain VAT registration details are automatically filled in the deregistration application.

- Choose the basis for VAT deregistration, and corresponding input fields and sections will be displayed accordingly.

5. Input The Qualifying Date:

The eligibility date for deregistration depends on the selected deregistration option. Specify the date for eligibility in the application. The effective date will be automatically populated in EmaraTax based on the eligible date. You can alter the effective date for deregistration if needed by providing a valid reason.

6. Fill and Upload The Data:

In this section, provide details on taxable products and expenses to substantiate the application. Choose from the provided options to input this data. Input the numerical values exclusively in UAE Dirhams (AED). Save your entries and proceed to the ‘Authorized Signatory’ section by clicking ‘Next Step.’

7. Confirm The Authorized Signatory:

Confirm the details of the authorized signatory and proceed to the next section by clicking ‘Next Step.’ Utilize the “Previous” and “Next” buttons to navigate back and forth, ensuring accuracy before advancing to the final step.

8. Review & Declaration:

Carefully examine all the entered details highlighted in the application. Ensure a thorough review before submitting the deregistration application by clicking ‘Submit.’

Deadline for VAT Deregistration Application Submission:

To start the VAT deregistration process, it is important to file your application with the Federal Tax Authority (FTA) within 20 business days following the occurrence that requires deregistration. This timeframe is explicitly outlined in Article 21 of the VAT Law. Adhering to this deadline is imperative to ensure a timely and compliant initiation of the deregistration procedure.

Penalty For Not Submitting a VAT Deregistration Application

Not adhering to the regulations set by the Federal Tax Authority (FTA) regarding VAT deregistration may result in financial penalties. Should a business neglect to submit the deregistration application within the specified timeframe outlined in the Tax Law, it could incur an initial penalty of AED 1,000. Subsequently, an extra AED 1,000 per month may be imposed, reaching a maximum penalty cap of AED 10,000. Businesses must adhere to the specified timelines to avoid incurring these penalties.

How Now Consultant Facilitates VAT Deregistration?

NOW Consultant ensures a smooth VAT deregistration process in compliance with UAE laws. Our experts analyze your situation comprehensively, simplifying the journey from review to exploring VAT deregistration possibilities. Beyond VAT services, we offer Auditing, Accounting, Bookkeeping, and more.

For inquiries or assistance with VAT deregistration or your business needs, Now Consultant is your reliable partner, providing expert guidance on documents and procedures and guiding you with up-to-date expertise on the necessary documents and procedures.