Maintaining accurate records of financial transactions is of utmost importance for businesses in accounting. One critical document that plays a significant role in this financial transaction process is the SOA. Businesses can use this statement to identify inconsistencies in their financial records and maintain accurate reporting. SOA helps businesses and customers manage payment obligations efficiently, making it a vital component of accounting services.

What Does SOA Stands For:

In the world of accounting and banking, SOA stands for Statement of Accounts.

What is a Statement of Accounts?

An SOA is a comprehensive record that provides an overview of the financial dealings between a seller and a buyer. It records every interaction between a business and its customers, detailing the products or services purchased on credit during a specific period. The SOA typically includes essential information such as customer details, business information, the closing date for the statement, the opening balance, the amount paid, the balance due, and the total invoice amount.

Why is SOA Important?

The importance of a Statement of Accounts in accounting cannot be overstated. Here are some key reasons why businesses rely on SOA:

1. Tracking Outstanding Balances

A statement of accounts helps businesses identify and keep track of the outstanding balances owed by customers. It provides an overview of the amount due and allows businesses to communicate payment reminders effectively.

2. Avoiding Disputes

By sending regular statements of accounts, businesses bridge communication gaps with their customers and minimize the chances of disputes. The SOA serves as a clear and concise record of transactions, ensuring transparency and reducing misunderstandings.

3. Payment Reminders

A statement of accounts is a convenient option for customers with multiple invoices to be paid. Instead of sending reminders for each invoice, businesses can consolidate all the information in a single statement, making it easier for customers to review their payment obligations.

4. Detecting Inconsistencies

Statements of accounts enable businesses to check for inconsistencies in records. By comparing the statement with their internal financial data, they can identify any transaction discrepancies or errors, ensuring accurate reporting.

5. Price Record

A statement of accounts gives businesses an accurate record of the prices associated with each item sold to customers. This helps track customer-specific information and aids in error identification.

6. Legal and Audit Compliance

SOA is valuable during audits, legal proceedings, and tax assessments. Offering thorough documentation of monetary operations facilitates adherence to regulatory obligations.

Types of Statement of Accounts

Businesses should acquaint themselves with diverse financial statements, as each type serves a distinct purpose and contributes to a holistic grasp of the company’s financial well-being. Here are the five key types of SOA:

1. Income Statement

The income statement, also named profit and loss, holds significant value among the various financial statements. It overviews a company’s profits/losses, revenues, expenses, net income, and earnings per share. This statement covers a specific period, such as a year or a financial quarter, and helps assess profitability and business performance over time.

2. Cash Flow Statement

The cash flow statement focuses on tracking a company’s cash flow. It shows how money enters and leaves the company, providing insights into its liquidity and financial strength. This statement categorizes cash inflows and outflows from various sources, including sales, interest income, loan proceeds, payroll, loan payments, taxes, and equipment purchases. Evaluating a company’s ability to fulfill financial responsibilities and maintain operational continuity aids investors in making informed assessments.

3. Balance Sheet

At a specific time, the balance sheet concisely outlines a company’s financial condition. It showcases the assets, liabilities, and equity of the business. Assets represent what the company owns, liabilities reflect its outstanding debts, and equity indicates the owners’ residual interest. The balance sheet helps evaluate a company’s solvency, liquidity, and financial health.

4. Statement of Change in Equity

The statement of change in equity highlights changes in a company’s share capital, retained earnings, and accumulated reserves. For sole traders and partnerships, it shows changes in the owners’ equity. In the case of a company, this statement reveals how equity shares have changed among all shareholders. It provides valuable insights into the organization’s movement and distribution of equity.

5. Statement of Accounts

While not traditionally considered one of the primary financial statements, the Statement of Accounts plays a vital role in managing customer transactions. It helps businesses track customer interactions, identify transaction errors, detect fraudulent activities, and prevent billing or payment mistakes. The format of the SOA can vary based on the specific requirements of the business and the information they choose to include in the customer invoice.

Example of Statement of Accounts:

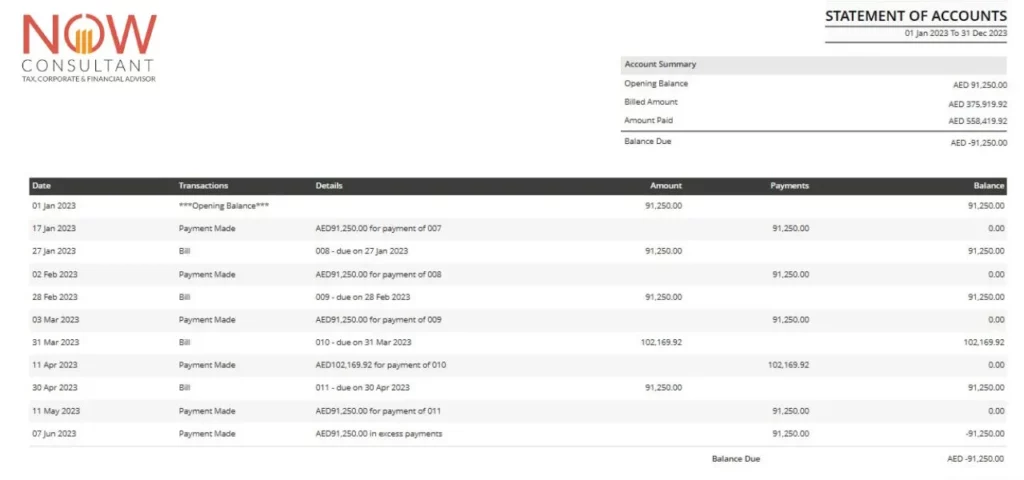

a comprehensive example detailing the statements of accounts (SOA) for both Company A (customer) and Company B (vendor) in the context of their contract for accounting, audit, and tax services in the United Arab Emirates valued at AED 1,000, covering six months.

1. Sales Invoice from Company B to Company A:

Company B initiates the process as the vendor by preparing a contract outlining the agreed-upon services and their value. Subsequently, they issue a sales invoice to Company A, the customer, reflecting the total amount due, i.e., AED 1,000. This invoice serves as a financial document indicating the obligation of Company A to make the payment.

2. Statement of Account for Company B (Vendor’s Perspective):

Company B’s statement of account, it will show an amount receivable from Company A. This represents the outstanding balance owed to Company B for the services rendered. The statement will include details such as the invoice number, the service period covered, and the due date by which the payment is expected.

3. Statement of Account for Company A (Customer’s Perspective):

From Company A’s standpoint, their statement of account will show an amount payable to Company B. This signifies the outstanding liability that Company A needs to settle for the services received. Similar to the vendor’s statement, the customer’s statement of account will include relevant information such as the invoice number, service period, and due date for payment.

4. Due Date and Balance in Company A’s Statement of Account:

Within Company A’s statement of account, the due date will be mentioned, indicating the deadline by which the payment should be made to Company B. Additionally, the statement will present the balance amount owed by Customer A, which will be the total outstanding balance after deducting any previous payments or adjustments.

Overall, the statements of accounts enable both Company A and Company B to track their financial transactions and obligations accurately. Company B’s statement of account highlights the amount receivable, while Company A’s statement emphasizes the amount payable. These statements provide transparency regarding the due date and the remaining balance owed by Customer A, facilitating effective financial management between the two companies.

How NOW Consultant Helps with SOA:

Generating accurate and timely Statements of Accounts can be complex for businesses. However, the process becomes seamless with NOW Consultant Accounting assistance. NOW Consultant enables businesses to create and share SOAs with customers through a single click. Additionally, clients can access their customer statements through the client portal, allowing them to handle outstanding payments efficiently.

FAQs:

What Is SOA In The Receipt?

The Statement of Accounts (SOA) on a receipt summarizes the financial transactions and balances tied to a specific account, detailing charges, payments, and outstanding amounts within a defined period. It aids individuals or businesses in tracking financial activities, reconciling records, and maintaining account accuracy.

Are the Statement of Accounts and Ledger The Same?

The Statement of Accounts (SOA) and a ledger are different. The SOA provides a summarized overview of financial transactions and balances for a specific account, including charges, payments, and outstanding amounts. On the other hand, a ledger is a detailed record of individual transactions, categorizing them by accounts and maintaining running balances.

What Is The Difference Between an Invoice and a Statement of Accounts?

An invoice is a payment request from a seller to a buyer, itemizing specific charges for goods or services provided. A Statement of Accounts is a summary report showing an account’s financial transactions, including charges, payments, and outstanding amounts.

What are Debit and Credit in SOA?

In a Statement of Accounts (SOA), debit represents increases in the account balance, reflecting expenses or assets. Credit signifies decreases in the balance, representing income or liabilities. Debit and credit entries in an SOA capture different financial activities, with debit indicating increases and credit indicating, decreases in the account balance.